Corn in the Land of the Tsars: An Examination of Russia’s Corn Trade in 2023

Talk to our team about AgFlow's offering →

Reading time: 2 minutes

Russia, renowned for its diverse landscapes and rich cultural history, is not often the first name that comes to mind when we discuss corn production and trade. However, it’s 2023, and things are changing fast in agricultural commodities. The corn trade, both export, and import, in Russia is taking center stage, but why, and what does it mean for you?

First things first, let’s address the question that’s likely on your mind. Why the sudden interest in Russia’s corn market? The country’s recent agricultural reforms and initiatives to boost domestic production are the answer. With an increased focus on self-sustainability, Russia’s corn yield has surged, making it a new player in the international corn market.

However, this isn’t to say that the journey has lacked challenges. Increasing domestic corn production has led to a shift in the nation’s trade balances, which requires careful analysis. On the one hand, it reduces dependence on imports, but on the other, it necessitates finding export markets to prevent oversupply. A corn surplus may sound like a good problem to have, but it can cause domestic prices to plummet, potentially hurting farmers. So how is Russia handling this tightrope walk?

Russia is engaging in bilateral trade agreements and leveraging international trade platforms to export its surplus corn to stabilize the market. This strategy is twofold – it prevents a domestic price crash while strengthening Russia’s global corn market position. For instance, countries in the Middle East and Asia have shown a keen interest in Russian corn, transforming trade dynamics in these regions.

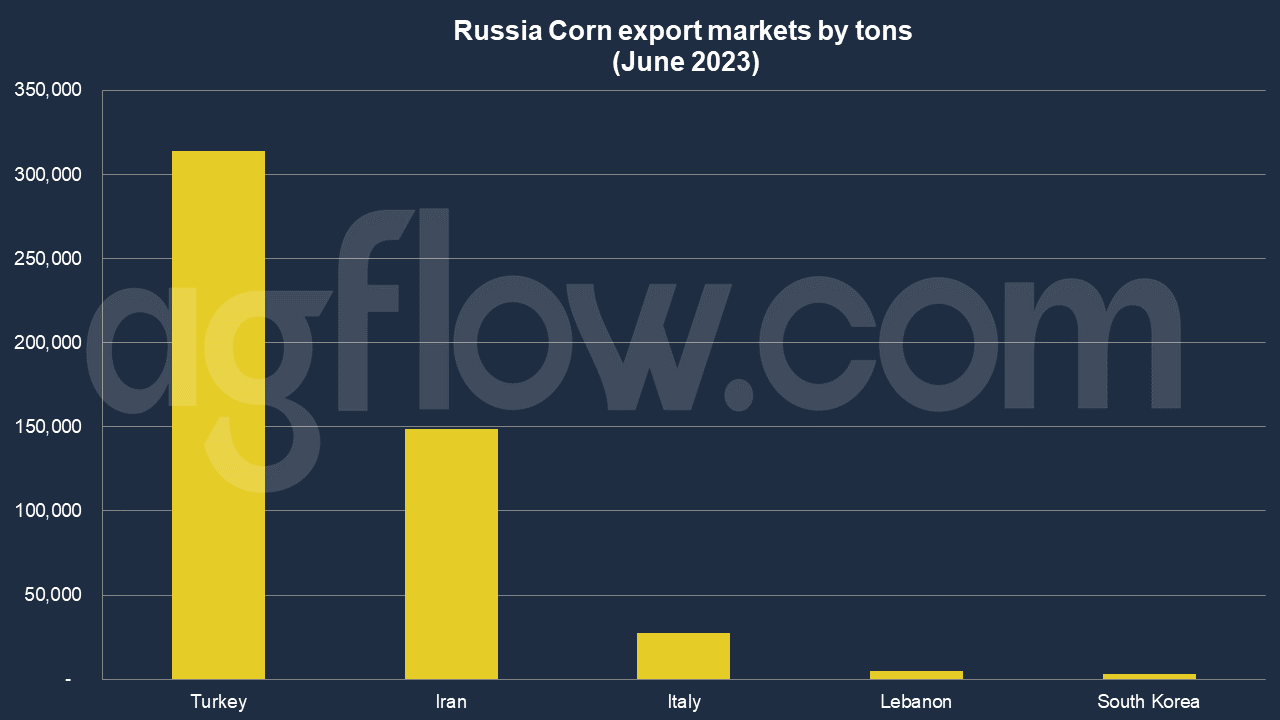

According to AgFlow data, Russia exported 0.3 million tons of Corn to Turkey in June 2023, followed by Iran (0.15 million tons), Italy (27,500 tons), Lebanon (4,900 tons), South Korea (3,000 tons) and Japan (2,930 tons). Total exports hit 2.1 million tons in Jan-June 2023. During the first half of 2023, June shipments were the largest with 0.5 million tons. The following months were May (0.46 million tons), March (0.4 million tons), February (0.3 million tons), and April (0.26 million tons). For EU buyers, only Greece was purchasing small amounts of Corn from Russia such as 2,880 tons and 3,000 tons.

Moreover, Russia’s geographical advantage must be considered. The country’s proximity to these regions allows it to offer competitive prices, making its corn exports a lucrative option. But as we well know, the trade winds can change quickly, especially in an era of global uncertainties and shifting geopolitical alliances. So, where does that leave Russia’s corn trade?

The future, although bright, has its challenges. Russia will need to continue balancing its domestic supply with global demand, which could impact factors like climate change, market trends, and international relations. Similarly, it must grapple with the technical challenges of enhancing yield while maintaining the ecological balance. Will it continue to be successful? Only time will tell.

At the heart of it all, the story of Russia’s corn trade in 2023 is a fascinating tale of resilience, reform, and adaptation. It underscores how local agricultural practices can have far-reaching international impacts even in an ever-globalizing world.

So whether you are a casual observer or a professional in the agricultural commodity industry, keep a keen eye on Russia’s corn trade. Its emerging status in this field promises to generate ripples that will likely influence global agricultural trends and practices. The land of the Tsars is now also the land of corn, and it’s a narrative that’s just beginning to unfold.

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time