Ethiopia Wheat: Output Increase Enables Export

Talk to our team about AgFlow's offering →

Reading time: 2 minutes

Wheat, a staple for many, is a pivotal player in the agricultural market. Among the countries deeply intertwined with the wheat trade is Ethiopia. But what’s been brewing in the Ethiopian wheat sector in 2023?

Why, you ask? Isn’t Ethiopia endowed with vast agricultural land? Indeed, it is. The crux lies in the burgeoning population and an increasing urban lifestyle, which amplifies demand for wheat-based products. This shift in consumption patterns means that even with the expansive farming landscapes, Ethiopia often finds itself in the realm of wheat imports.

The Trade-Offs: Between Local and Global Markets

When pondering about Ethiopia’s wheat trade, one might ask: Why not increase local production? The answer is not as straightforward as it seems. Boosting domestic wheat production demands substantial inputs, both in terms of infrastructure and technological advancements.

On the other hand, importing provides an immediate solution. It’s a balancing act. Do we invest time, effort, and money now and hope for a sustainable future, or do we rely on global markets, taking advantage of competitive prices? These are the trade-offs policymakers have had to grapple with throughout 2023.

The Global Wheat Scenario: A Double-Edged Sword

The world market for wheat has its challenges. Fluctuating prices, largely influenced by production outputs from major producers like Russia, the U.S., and Australia, directly impact Ethiopia’s import costs. So, while importing might seem a feasible solution, it’s akin to walking on a tightrope—beneficial when prices are low but a burden when they soar.

A government drive to boost Ethiopian wheat production is expected to result in a 27% increase in output this season, enabling the Horn of Africa nation to export the grain. Economic reforms by Prime Minister Abiy Ahmed’s government include a planting campaign to wean the country off imports.

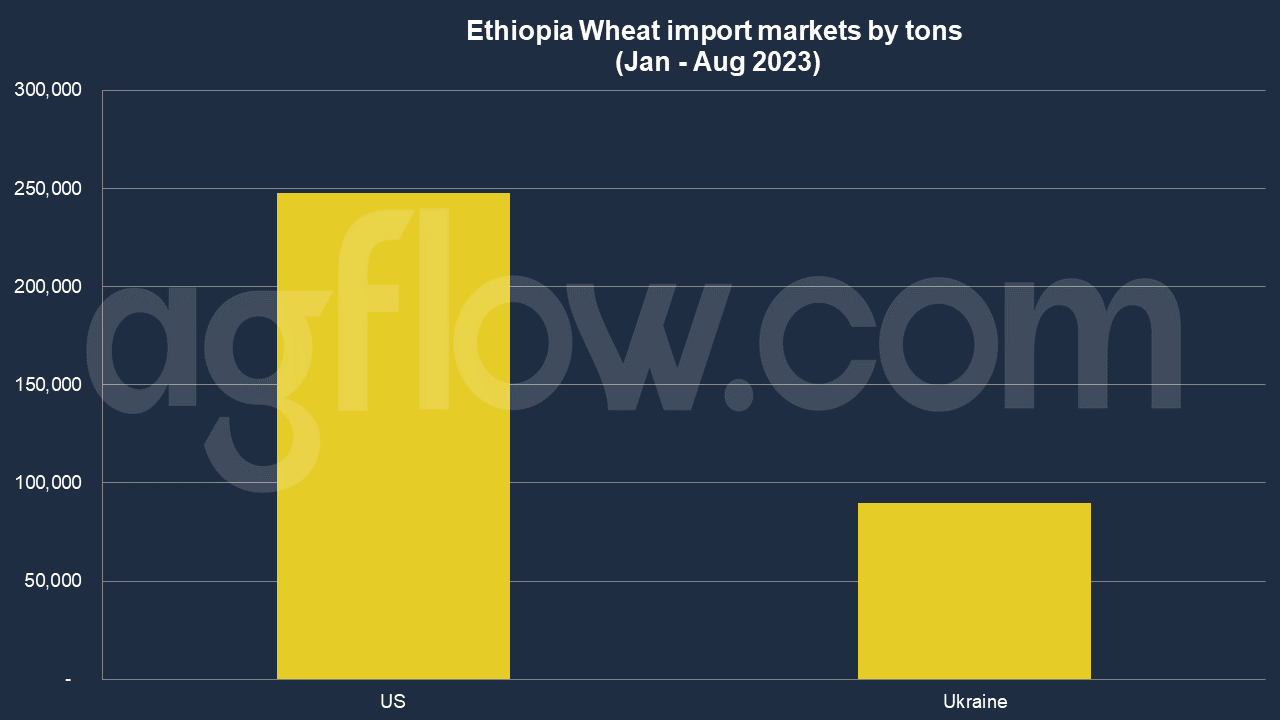

According to AgFlow data, Ethiopia imported 0.33 million tons of Wheat in Jan – Aug 2023. The United States supplied 0.24 million tons of Wheat, followed by Ukraine (90,000 tons). Average volume of shipment was 48,242 tons. Ethiopia purchases Wheat from Ukraine by 30,000 tons while imports large volumes such as104,000 tons from the US.

Challenges Looming on the Horizon

An analogy fits well here: navigating the wheat market is much like sailing in turbulent waters. The winds of change, characterized by global climate anomalies and geopolitical tensions, have made the wheat trade more unpredictable than ever.

A salient challenge for Ethiopia in 2023 has been climate variability. Unexpected droughts and unseasonal rains have adversely impacted local production. Add to this the increasing global prices, and the cost of ensuring food security becomes even steeper.

Moreover, there’s the question of quality. Can the wheat be imported match up to the nutritional needs of the Ethiopian populace? Or is it a mere fill-in-the-gap approach, prioritizing quantity over quality?

In Conclusion: Wheat’s Twisted Tale in Ethiopia

So, where does this leave Ethiopia in its wheat saga? Though fraught with challenges, the path forward isn’t devoid of hope. An increased focus on technology, sustainable farming practices, and strategic international partnerships can pave the way for a more self-reliant wheat sector.

But as of 2023, it’s evident that the journey of wheat in Ethiopia is more than just about grains. It’s about the decisions, the trade-offs, and the persistent efforts to ensure that every Ethiopian has their daily bread. As we ponder the future, one can’t help but wonder: Will Ethiopia find the perfect blend of local production and imports? Only time and the winds of change will tell.

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time