Canada Wheat: Indonesia Tops, But More Sales to Africa

Talk to our team about AgFlow's offering →

Reading time: 2 minutes

Canadian national Wheat production is projected to decrease by 13% year over year to 29.8 million tons in 2023. The decrease is attributable to lower yields, which are expected to fall by 17.6% to 41.7 bushels per acre because of dry conditions across the Prairies, offsetting higher anticipated harvested area, which is expected to rise 5.6% to 26.3 million acres.

The projected decline in total Wheat output is largely attributable to spring Wheat, which is expected to fall by 12% to 22.6 million tons. Spring Wheat yields are anticipated to fall by 18% to 43.6 bushels per acre, while harvested area is expected to increase by 7% to 19 million acres.

Durum Wheat harvested area is expected to decrease by 1.5% to 5.8 million acres, while yields are anticipated to fall by 29% to 25.5 bushels per acre, contributing to lower anticipated durum Wheat production (-30% to 4.1 million tons).

Wheat harvested area in Saskatchewan is projected to rise by 5.9%, while yields are expected to fall by 22% to 33.2 bushels per acre, resulting in a 18% decrease in production to 12.6 million tons.

Wheat production in Alberta is projected to decrease by 17% from 2022 to 9.4 million tons in 2023. This is the result of lower anticipated yields (-20% to 44.6 bushels per acre) offsetting higher anticipated harvested area, which is expected to rise by 3% to 7.7 million acres.

In Manitoba, Wheat harvested area is expected to rise by 6.2% to 3.2 million acres, while yields are anticipated to decrease by 7% to 54.1 bushels per acre. Total Wheat production is anticipated to fall by 1.0% year over year to 4.7 million tons.

Wheat output in Ontario (the majority of which is winter Wheat) is projected to rise by 13.6% to 2.7 million tons year over year on higher harvested acres (+21%), offsetting lower yields (-6.3%).

Wheat Trade Pattern

Canada’s cereals sector leads the country’s agriculture exports with annual exports to over 70 countries with an estimated value of 8.5 billion CAD. Cereals Canada supports Canada’s ongoing and forthcoming negotiations with the UK, India, Indonesia and the Association of Southeast Asian Nations (ASEAN).

Roughly half of Canada’s non-durum Wheat is exported to Asia. The West Coast is the biggest export gateway, especially for Asian markets. However, 25 per cent of all Canadian Grain (Wheat, canola, Grains, oilseeds and pulses) exports transported on bulk vessels travel through the Great Lakes-St. Lawrence River Waterway. Grain exports through the Great Lakes-St. Lawrence transport corridor are destined for markets in the U.S., Mexico, Europe, South America, Middle East, Africa and Asia.

The entire Port of Vancouver saw an overall increase of 11 per cent in cargo volumes, when the first half of this year is compared to the same period last year. When it comes to Grain exports, numbers are up sharply which is partly explained by a previous drought, which reduced harvests. Nevertheless, shipments of bulk Wheat spiked by 144%, as world markets adjust to the effects of Russia’s invasion of Ukraine in 2022.

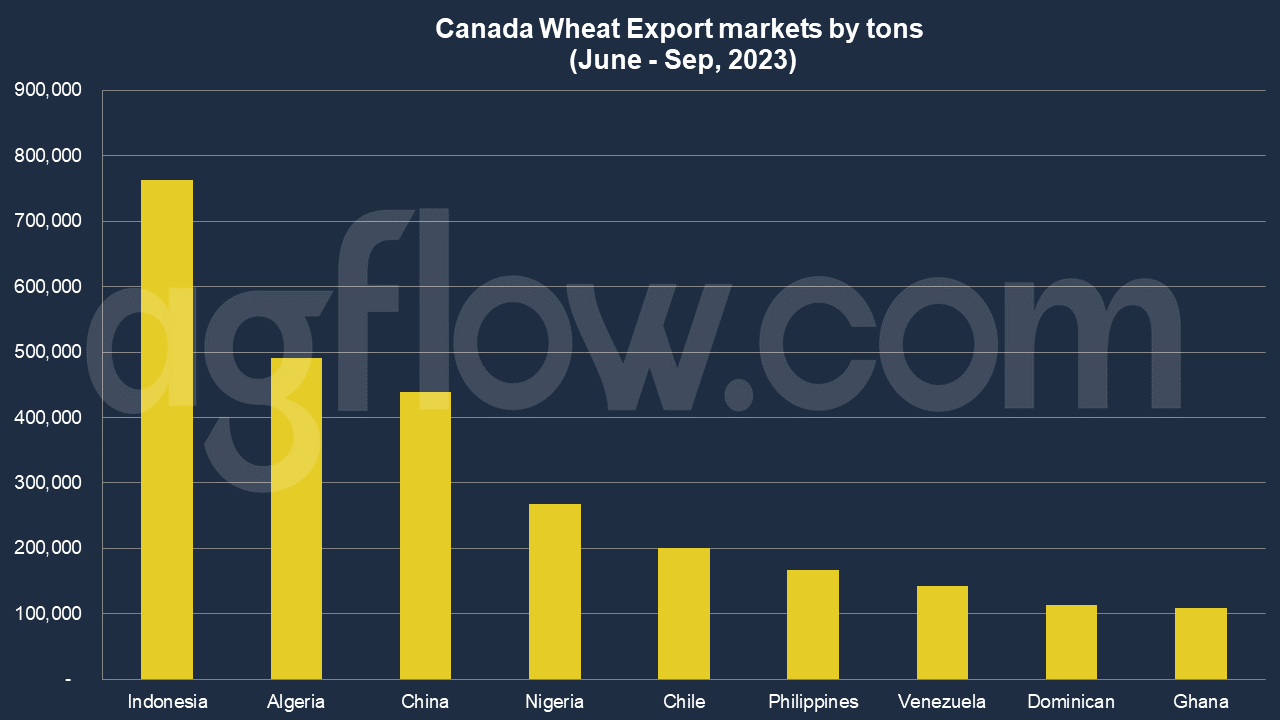

According to AgFlow data, Canada exported 0.76 million tons of Wheat to Indonesia in June – Sep 2023. The following markets were Algeria (0.5 million tons), China (0.43 million tons), Nigeria (0.26 million tons), Chile (0.2 million tons), the Philippines (0.16 million tons), Venezuela (0.14 million tons) and Dominican (0.11 million tons). Total exports hit 11 million tons in Jan – Sep 2023.

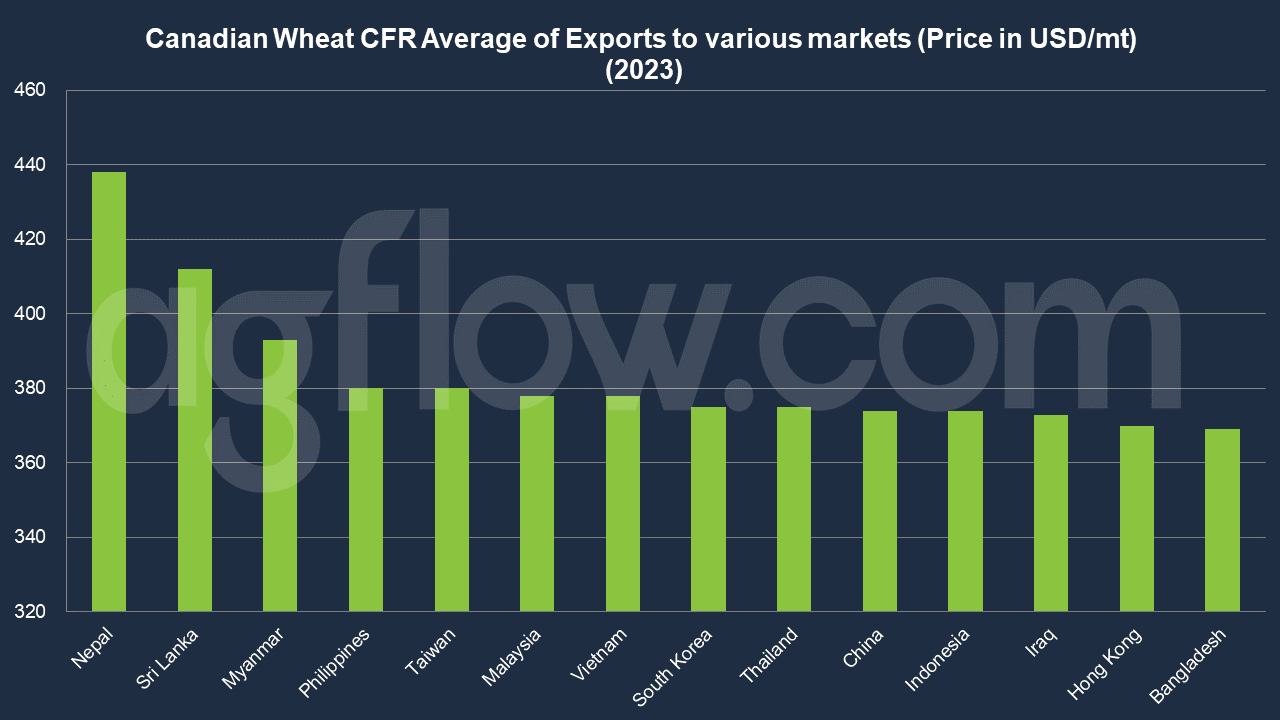

Canada quoted Nepal the highest CFR price, $438 on average, this year. This is related to Nepal’s land-locked location. The following 2 countries were Sri Lanka ($412) and Myanmar ($393). Bangladesh’s was the lowest with $369.

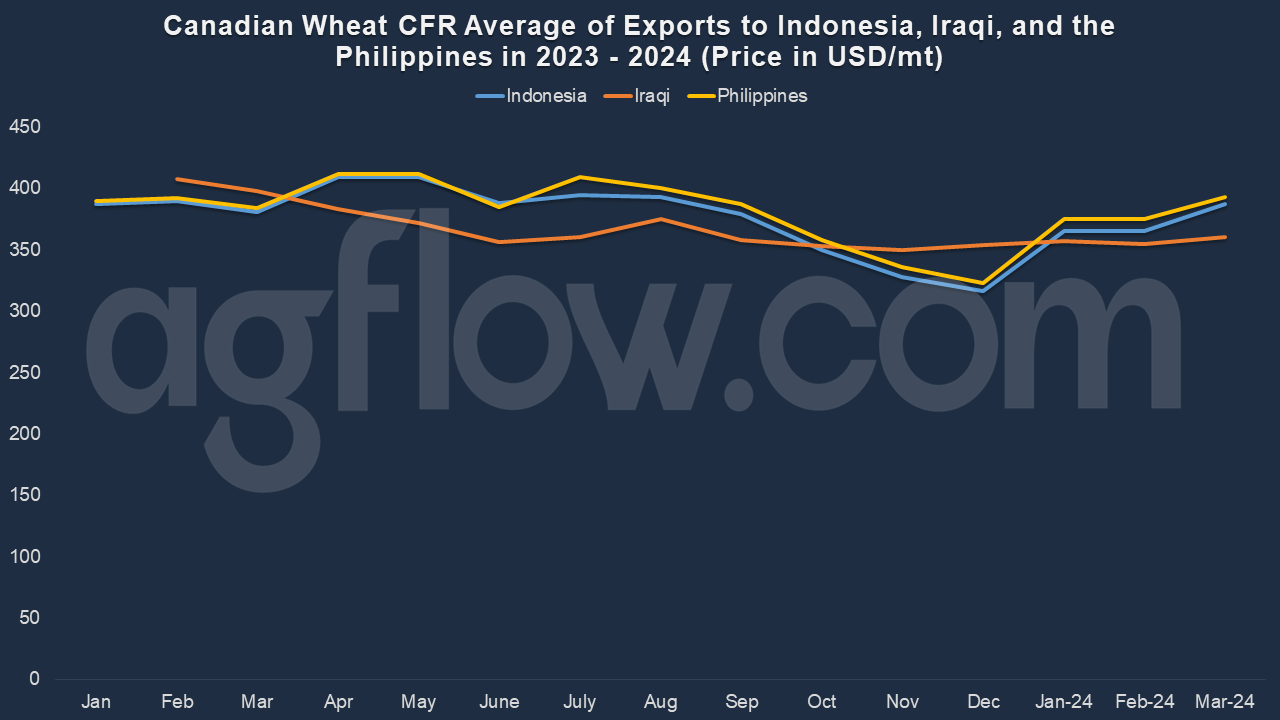

For selected countries, trends of CFR price showed a similar situation for Indonesia and the Philippines. Canada quoted lower price for the coming December shipments for both countries. CFR quote for Iraqi was lower than Indonesia and the Philippines from Apr till Oct. For November and December, this price level goes higher than these 2 Asian Nations.

In 2021, Canada exported Wheat worth $6.91 billion, making it the 4th largest exporter of Wheat in the world. At the same year, Wheat was the 12th most exported product in Canada. The main destination of Wheat exports from Canada are: China ($663M), Japan ($541M), Indonesia ($516M), Peru ($437M), and Colombia ($415M).

The same year, Canada imported Wheat worth $59.8 million, becoming the 95th largest importer of Wheat in the world. Canada imports Wheat primarily from: United States ($54.9M), United Arab Emirates ($4.82M), New Zealand ($17.9k), India ($9.82k), and France ($7.01k).

Export Rival – Australia

During the past 15 years Grain supply chains in Canada have undergone substantial renewal and reform, more than doubling the number of high throughputs receival sites located on high capacity, highly efficient rail lines. The majority of Canadian Grain is now delivered through this infrastructure which has reduced the time taken to deliver Grain to port by one third.

Production and export of Grain is less variable in Canada than Australia and is growing at a much faster rate. Climate change trends are favoring Grain production in Canada while slowing productivity growth in Australia.

Canadian supply chains still operate at a higher cost than Australian supply chains, but with higher yields, Canada can deliver Grain into Asia at almost the same cost. This is despite the long-distance Grain must travel from inland Canadian growing areas to port, and then the long distance to Asian markets.

The Canadian Grain industry also maintains a strong independent presence promoting Grain in international markets. During 42 years of operation, the Canadian International Grains Institute (CIGI) have put 39,000 people through its programs, 14,000 of whom are in Australia’s strategic Asian markets. Australia does not have an equivalent presence in key export markets.

The total cost of a typical export Grain supply chain in Canada is about $107 per ton compared with about $87 per ton in Australia. Grain storage and transport costs are higher in Canada than Australia. This is because most Grain in Canada is stored on-farm and needs to be transported more than 1000km to port. Australia’s export Grain is mostly stored in-warehouse and is transported less than 400km to port.

Port receival, handling and vessel charges in Canada are two thirds of the equivalent charges in Australia — $14 per ton in Canada versus $21 per ton in Australia. The cost of producing a ton of Wheat is about $18 lower in Canada than Australia. This is mainly due to the higher yields achieved in Canada.

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time