Here’s Why US Agricultural Exports Have Decreased in August 2021 v. August 2020

Reading time: 6 minutes

Although US agricultural exports are on a record pace in 2021, both in terms of volume and sales values, August 2021 total export volumes decreased by 50% year-on-year. The strong pace initiated in 2021 is mainly due to the Chinese pork herds recovery and increasing domestic demand that bolstered Chinese imports, since Q4 2020. With USDA projections firmly asserting this trend (farmpolicynews.illinois.edu), August 2021 agricultural export numbers should have beaten those of 2020. In fact, the fast export pace in early 2021, as well as adverse cash market conditions and freight rates, reduced the incentive to import US Agricultural products later in Q3 2021 and ultimately led to export volumes tanking.

US Agricultural Exports Growth in 2021

As the global demand for agricultural products is increasing, and with the US being a leading producer of the principal Grains and Oilseeds commodities, US agricultural export volumes in the first half of 2021 easily surpassed those of 2020.

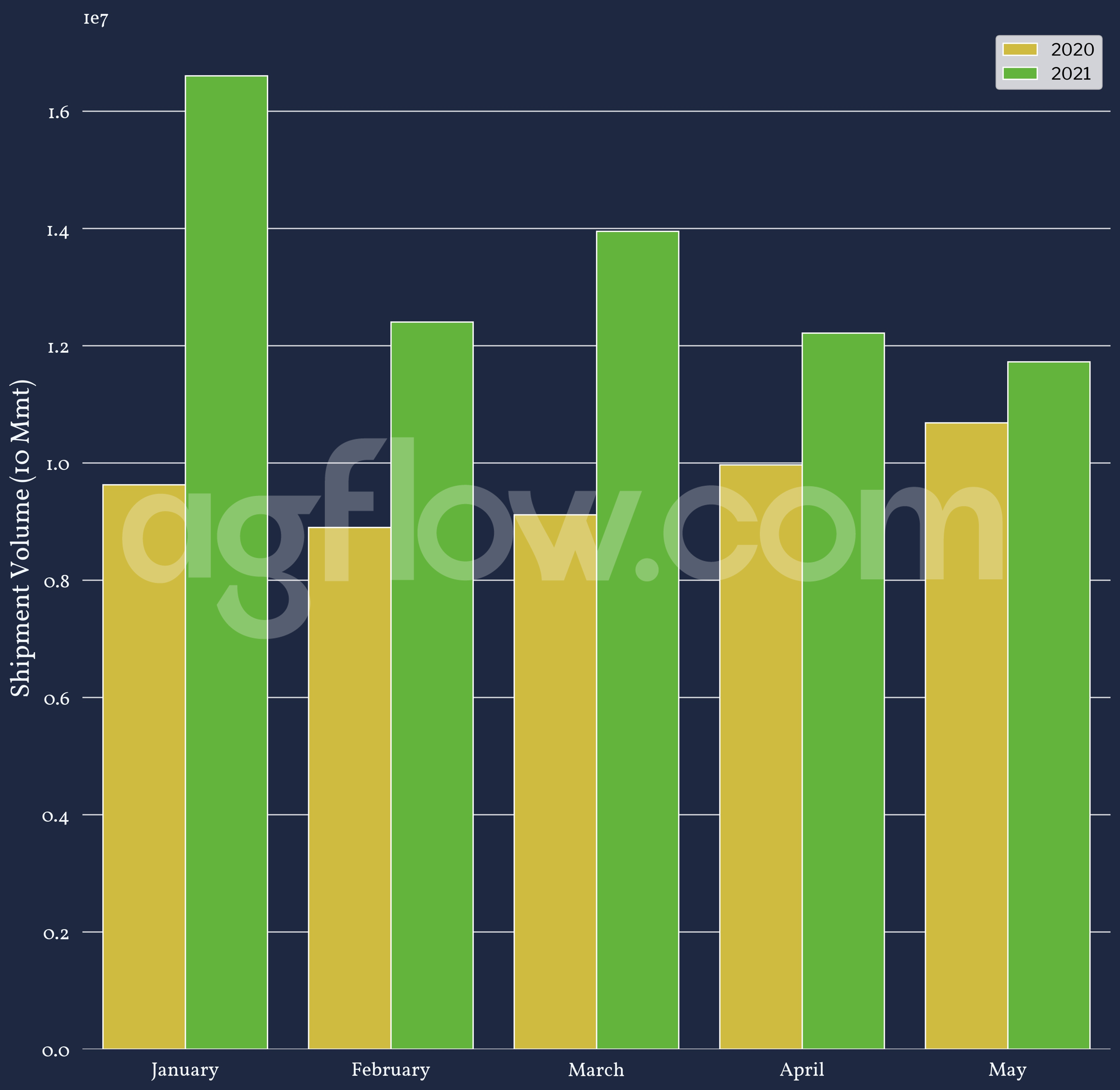

Figure 1: Total Monthly US Export Volumes Between Jan & May 2020 v 2021

Figure 1 shows the disparate volumes between 2020 and 2021. In January 2021 alone, US agricultural export volumes were around 60% higher than in 2020. However, the graph also shows that the difference between 2020 and 2021 export volumes decreased over time to approximately 10% in May YoY. The significant increase in exports in the first three months is mainly due to China’s aggressive imports (agriculture.com).

Figure 2: Distribution of US Agricultural Exports Destination Between Jan & May 2021

The pie chart in Figure 2 displays the distribution of destinations for Agricultural exports during the first five months of 2021. It shows that China is the single largest unique importer, representing almost a quarter of all US exports. Overall, the top five destinations (China, Mexico, Japan, South Korea, and Colombia) represent more than 65% of the total US agricultural exports over the period. As such, they are a representative sample of the total US agricultural exports.

Figure 3: US Agricultural Export Volumes for the Top 5 Destinations per Commodity

Comparing the main 5 destinations for US agricultural exports volumes between January and May 2021, it appears that China bought the majority of US Soybeans exports in that period. In fact, China bought record amounts of Soybean during that season(producer.com). Moreover, countries like Japan and Mexico contribute significantly to the US Corn exports, with Mexico representing about 25% of all US Corn exports. As such, US agricultural exports depend on specific countries with specific commodities’ needs.

Live Track Cargoes From the US to

35 Port Destinations With AIS Data

Free & Unlimited Access In Time

Read also: Are Traders Shipping Cargo On Larger Vessels Given the Dry Bulk Cargo Ocean Freight Rates?

What Drove the US Agricultural Exports to Tank in August 2021

The US agricultural export pace started slowing down in April 2021 and was only 10% ahead of 2020 in May 2021. In the last three months, the export pace continued to slow down, with US agricultural export volume being 50% lower in August 2021 than in 2020.

Figure 4: Total Monthly US Export Volumes Between Jun & Aug 2020 v 2021

In Figure 4, although June and July 2021 export volumes are lower than in 2020, the critical gap between July and August indicates significant events. As the US agricultural exports depend heavily on a handful of countries, those import countries set the global US export trend.

Read also: How China Feed Strategies Changed With Soybean Meal Prices

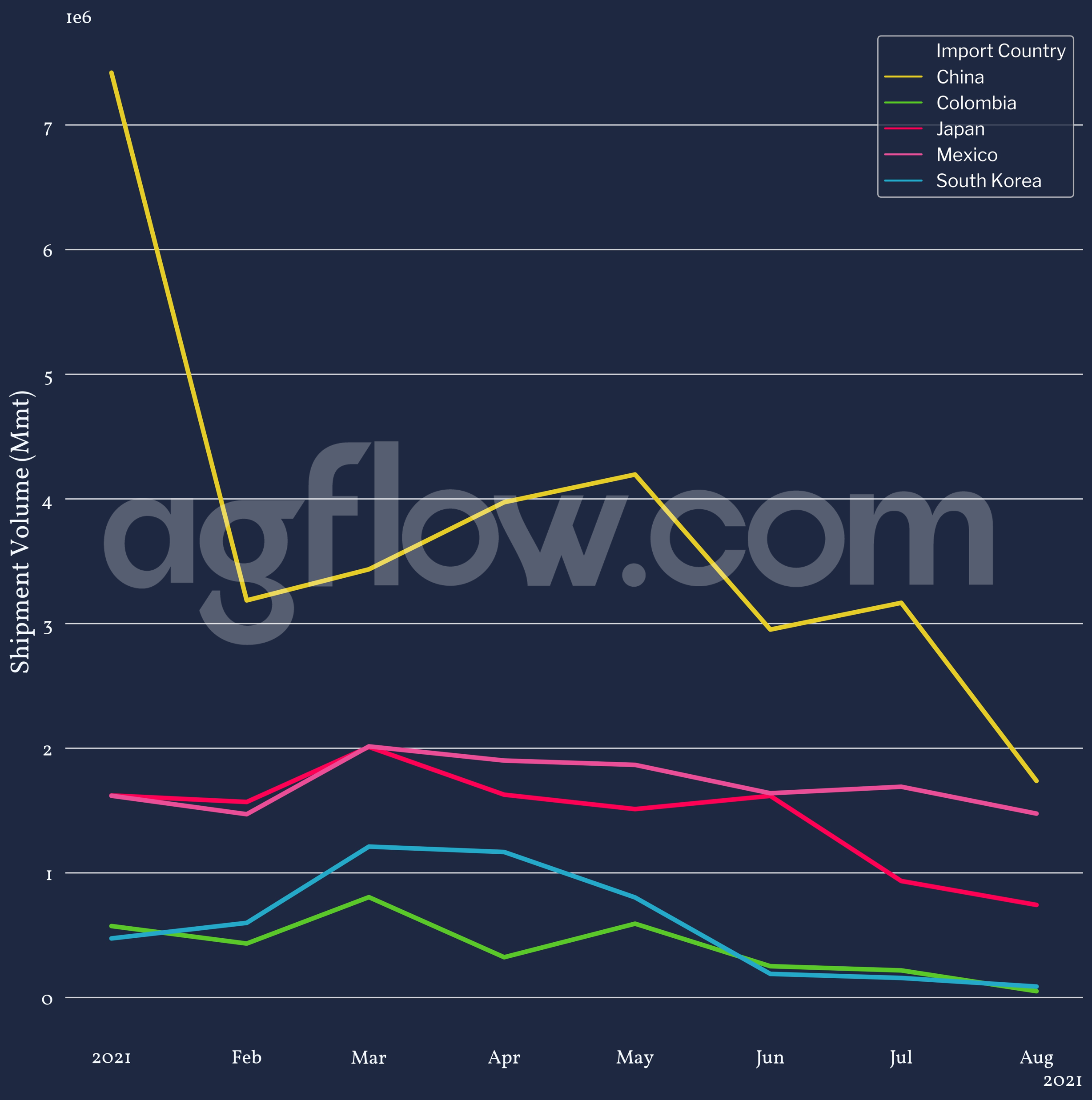

Figure 5: US Monthly Agricultural Export Volumes by Country in 2021

Analyzing US agricultural export volumes in 2021 for the top 5 countries, displayed in Figure 5, reveals that China has lifted American export volumes throughout 2021, and in particular, while export volumes for the other four main destinations started decreasing in April 2021. Nonetheless, by June 2021 Chinese imports started declining as well, and were finally close to Mexican import numbers in August 2021.

This trend coincides with the significant weather concerns that started driving the US agricultural markets by Spring 2021. Indeed, the extreme weather patterns in the US in 2021 led to droughts in all major production areas as soon as April. This, in turn, contributed to the bull market and provoked a steep rise in prices’ volatility. At the same time, freight rates surged globally because of the Chinese demand. With some Chinese terminals not re-opened yet, congestion in ports became prevalent, peaking at up to 14-days waiting time, bolstering freights even further.

Moreover, events such as the new Mexican policy on GMO Corn delayed shipments (feedstrategy.com) for the primary US Corn export destination.

Read also: How the Extreme Weather Conditions Are Shaping the US Wheat Market in 2021-22

View all Shipments in the last 12 Months Out of the US for 20 Oilseeds and Grains

to 117 Destinations

Free & Unlimited Access In Time

In a Nutshell

US agricultural exports in 2021 are on pace to break record volumes and sales thanks to strong global demand, particularly from China increasing Grains and Oilseeds physical prices across the board. From January 2021 to May 2021, the export pace was high, with a 60% increase YoY in January.

However, the pace slowed down and by June 2021 the monthly US agricultural export volume was below the 2020 level. While China lifted US exports throughout the year, exports to Japan, Mexico, Colombia, and South Korea started decelerating by April 2021. The adverse weather-induced market conditions, in addition to inflating freight rates, led countries, which were moving at a strong pace before, to slow down and wait for the market to stabilize. Additionally, other factors – such as the Mexican GMO policy – also contributed to slowing down exports and ultimately to US agricultural exports being 50% lower YoY in August 2021.

In August, China bought 3.3 Mmt of Soybean crop for 2021/22 delivery, starting in September 2021 with the new marketing year, a promising number for the US agricultural exports pace. Therefore, August 2021 seems to be an outlier month for US agricultural exports. Nonetheless, Hurricane Ida provoked extensive logistical damage in ports and terminals in the US Gulf area. As it represents 59% of US agricultural exports’ capacity, and with a return to normality likely to take 2-4 weeks, exports in September 2021 will be majorly hampered and thus threatens the pace set for 2021.