Maritime Logistics Is Hampering French Wheat Competency?

Talk to our team about AgFlow's offering →

Reading time: 2 minutes

This year, France produced 35.1 million tons of Wheat – a good performance, representing an increase of 4% compared to last season. The average soft Wheat yield approached 75 q/ha, 3.5% higher than the 2018-2022 average. France has the best Wheat yield per hectare compared to all the other producing powers. Concerning French soft Wheat, the qualitative tests, carried out jointly with Arvalis, show promising results on a national average, as follows:

· Protein content: 11.6%

· Water content: 13.1%

· Baking strength: 176

· Elasticity: 57.3

· Falling time: 240s (on 91% of the harvest)

60% of this production is classified in the premium or higher category. However, this represents a decrease compared to 2022. France has a positive harvest, with a reasonable quantity, despite a slight drop in quality. For the end of the 2023/24 campaign, FranceAgriMer is revising national soft Wheat stocks downward by 150 kt in October (2,768 Mt).

While the Wheat harvest in France promises to be satisfactory in quantity, professionals fear a “saturation” of storage capacities while the silos are filling faster than they are emptying due to sluggish exports.

France alone represents 10% of world Wheat exports. France should expect increased competition from Russian Wheat over time because the country is vast, and, with climate change, its agricultural areas are growing towards the north. However, the south is more exposed to severe droughts. Russian production is thus subject to hazards, but its Wheat is higher in protein and cheaper.

For their part, the Americans have light production constraints. The US can cultivate GMO plants, has virtually no regulatory restrictions or concerns about supplying inputs, and has an abundance of fuel.

Russian authorities have imposed a “floor price” on Wheat exporters in recent months, which seems to have given a place to the French and Romanian offers during the GASC tenders. Even if it has not been officially announced, this floor price would be around $270 per ton FOB (excluding transport costs, taxes, and insurance). In the last few months, Russian Wheat suppliers had submitted offers of FOB price of $265 per metric ton to GASC, believing it to be the established price floor.

The weakness of domestic demand leaves a “substantial” available exportable volume of 17 Mt. The potential outlet to the countries of the European Union is estimated at 7.5 Mt, driven by sustained flows towards the Iberian Peninsula (2.3 Mt, compared to 1.74 Mt in the five-year average).

On the other hand, historical partners Algeria and Morocco have become more competitive markets in recent years. On the side of Egypt, which has represented a moderate share of French exports in recent years, “the payment conditions are quite hard, ” making French commercial proposals more expensive than competition from the Black Sea.

Between May and July: with differences sometimes exceeding $40/t in favor of Russian origin, French Wheat was not capable of filling the export order to third countries”.

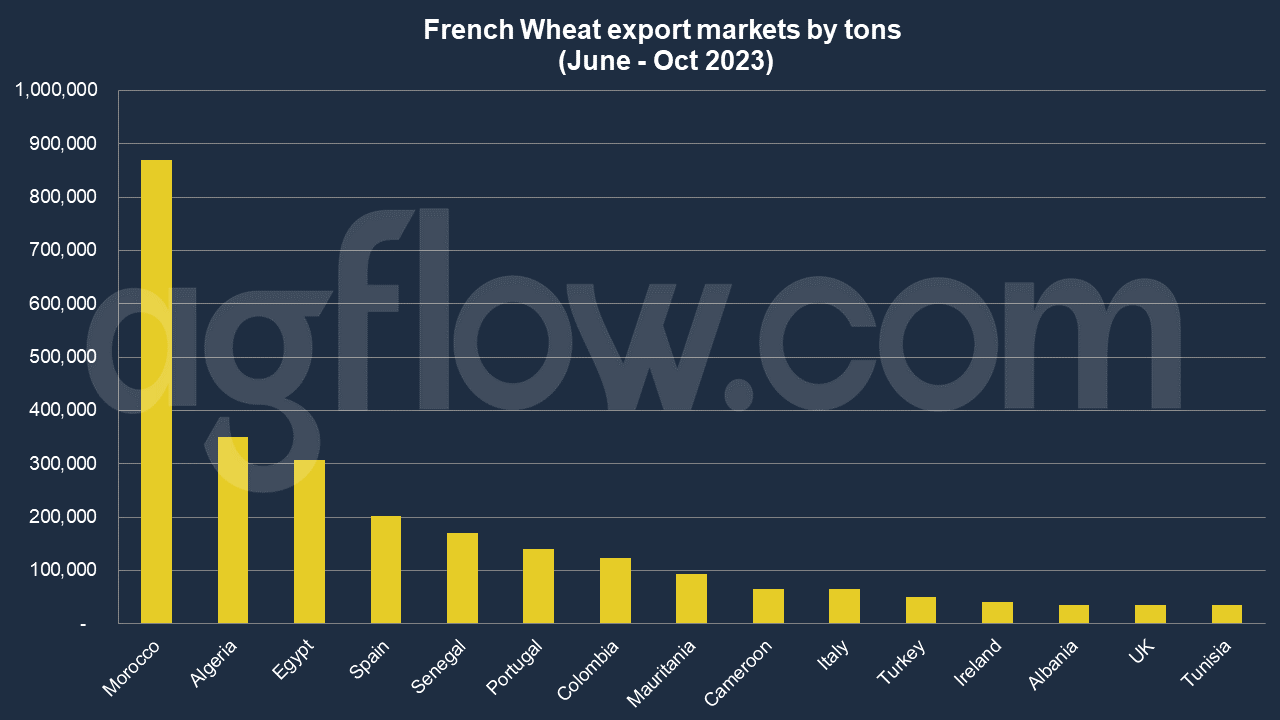

As per AgFlow data, France exported 0.87 million tons of Wheat to Morocco in June – Oct 2023. The following markets were Algeria (0.35 million tons), Egypt (0.3 million tons), Spain (0.2 million tons), Senegal (0.17 million tons), Portugal (0.14 million tons), Colombia (0.12 million tons) and Mauritania (93,783 tons). Total exports hit 5.2 million tons in Jan – Oct in 2023. In terms of imports, the country purchased 0.18 million tons of Wheat in the same period.

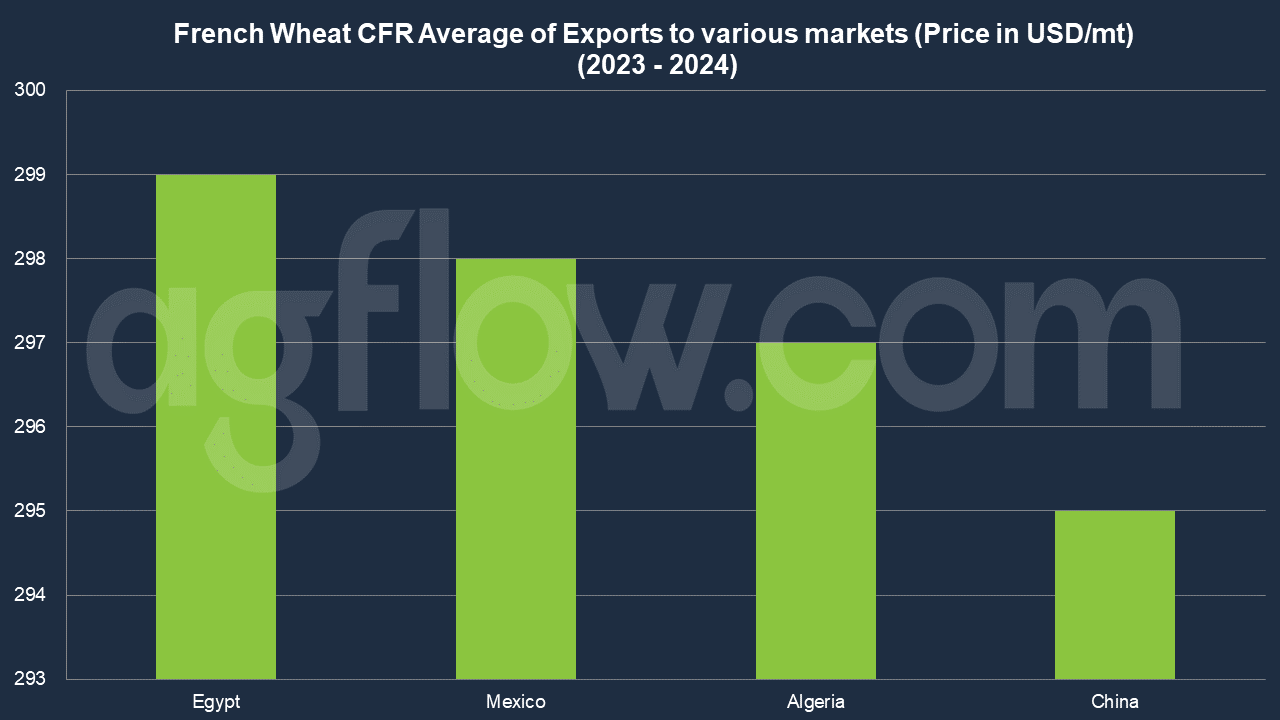

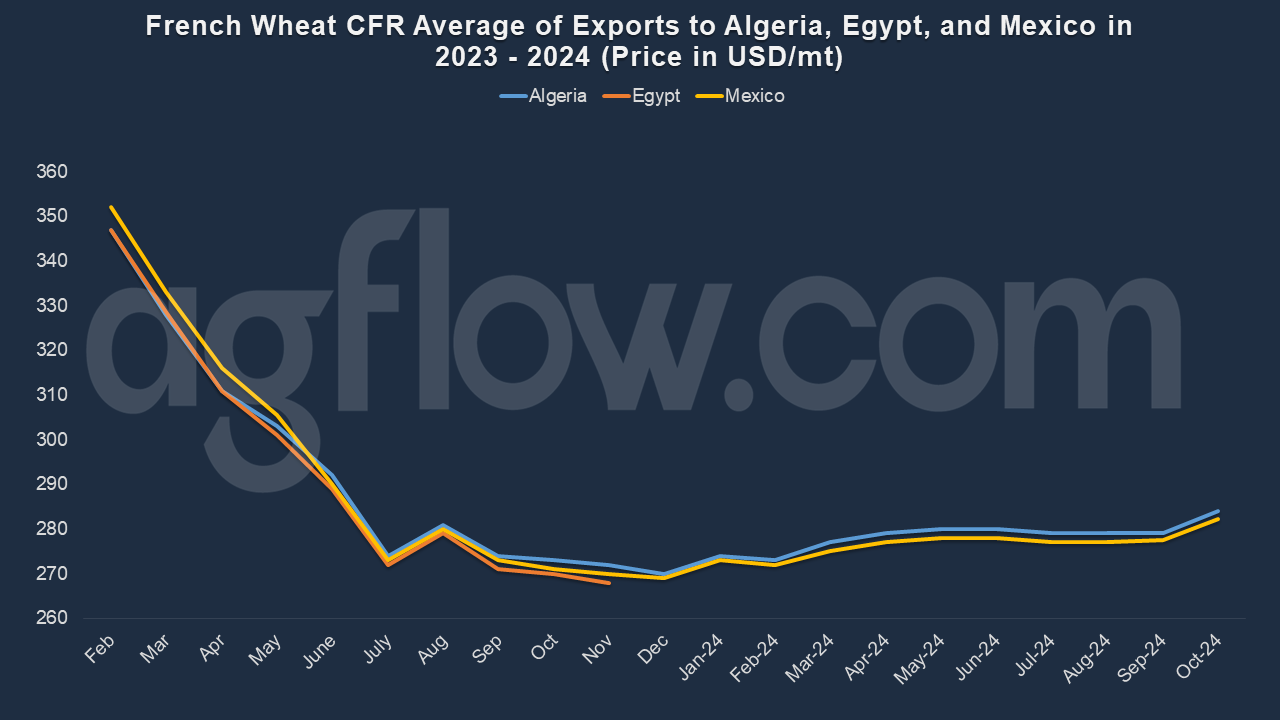

France quoted Egypt the highest CFR price, $299 on average, this year, followed by Mexico ($298), Algeria ($297), and China ($295). For selected countries, trends of CFR price showed a similar situation. The price started falling from the last February till July. The lowest level for Algeria and Mexico is expected to be in December. Since then, it is set to grow gradually.

In 2021, France exported Wheat worth $4.74 billion, making it the 6th largest exporter of Wheat in the world. In the same year, Wheat was France’s 19th most shipped product. The leading destination of Wheat exports from France are Algeria ($652 million), Belgium ($619 million), the Netherlands ($531 million), China ($498 million), and Spain ($364 million).

The same year, France imported Wheat worth $127 million, becoming the world’s 71st most significant importer of Wheat. France imported Wheat primarily from Germany ($45.2 million), Spain ($17.7 million), Belgium ($15.8M), Romania ($14.1 million), and Latvia ($10.1 million).

Few French Ports Can Accommodate Panamaxes

Black Sea Wheat, very competitive, slows down French exports. This is found in the format of the ships: on the one hand, small ships (mini-bulk bulk carriers, Handysize, Handymax) adapted to French ports and small European, North African, and West African ports, and on the other, giant ships for ocean flows towards the Middle East, China but also Egypt, which require Supramax or Panamax for cargoes of 50,000 to 80,000 tons deadweight.

A real weakness of the French industry is that few ports can accommodate Panamaxes. These are La Rochelle, Montoir, Dunkirk, and soon Port-la-Nouvelle. Rouen and Nantes can partially accommodate them, but the cargo must be reloaded. Conversely, their competitors are on large ships, particularly in the Black Sea.

West Africa, the Middle East, and the Far East require larger volumes, transported in large ships that require ports of entry. This makes French port situations “less favorable”: “an upstream estuary port, for example, Nantes or Rouen, does not have the same drafts as a mouth port.”

With global warming, with agricultural practices oriented towards less fertilizer, with organic, perhaps French performance in large-scale exports will be limited. In this hypothesis, the “large trade” in Grains would be monopolized “for example, by Brazil, North America, and the Black Sea,” leaving France with regional and local trade. So, the competition criteria are not only in production prices and Grain qualities but also in port passage and maritime logistics.

Rouen ranks first among French ports for volumes of cereals exported to third countries (5.77 Mt in 2022) ahead of La Rochelle (2.06 Mt) and Dunkirk (0.975 Mt), La Rochelle, on the other hand, takes the prize for exports to the European Union, with 0.72 Mt exported, ahead of Rouen (0.445 Mt) and Bayonne (0.32 Mt).

French Wheat struggled to maintain a competitive level compared to Black Sea origins; prices have fallen by more than 50% in one year, reaching €230/t for the Rouen delivery quotation in September.

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time