Morocco Subsidizes the Grain Seed’s Price

Reading time: 2 minutes

As of the 2019/2020 crop year, soft Wheat production in Morocco amounted to nearly 18 million quintals. The region of Rabat – Salé – Kénitra accounted for almost six million quintals, the most significant production registered in the country. The Government of Morocco released its final Wheat and barley production numbers for the 2022 crop, including 1.89 MMT of common Wheat, 0.81 MMT of durum Wheat, and 0.7 MMT of barley. The MY2022/23 Wheat and barley harvest were down 67 percent compared to the previous season due to severe drought.

Morocco’s cereal production in 2022 was set to reach its lowest level last year since 2008 due to the most severe drought to have hit the country in almost a decade. Morocco’s overall Wheat production was estimated to reach 32 million quintals in 2022, 69% down from the previous year, according to the Ministry of Agriculture. As agriculture accounts for an average of 11% of the country’s Gross Domestic Production, the drop in cereal production can carry a heavy toll on the country’s economy. Commenting on the potential impact on Morocco’s agriculture, the Ministry said it projects a 1.7-point drop in this year’s GDP. Last year’s drought mainly affected the autumn harvest. Spring crops were expected to fare better, the Ministry explained in a statement, adding that it expects olives, citrus, and vegetable output to offset part of the damage.

On October 6, 2022, the Ministry of Agriculture and the Ministry of Finance published a joint Ministerial decision to provide a subsidy for certified seed for the 2022-2023 crop year. The subsidy is to discount the price of planting seeds: common Wheat at -$210/MT, durum Wheat at -$290/MT, and barley -$210/MT. The Government of Morocco continues to subsidize bread Wheat imports based on a fixed flat-rate premium in response to high global Wheat prices. The current subsidy measures are valid until April 30, 2023. The Government of Morocco also supports bread Wheat imports based on a fixed flat-rate premium in response to rising Wheat prices. The baseline price is calculated every two weeks, based on prices assessed from four origins (Black Sea, France, Argentina, and the United States). The previous restitution system was valid until December 31, 2022.

In MY 2021/22, Morocco has turned to South America (Argentina and Brazil) to meet its Wheat supply, while Wheat imports from Ukraine and Russia are down 46% and 85%, respectively. Post revised its MY and TY barley numbers for 2020/21 and 2021/22 based on trade-to-date data. The late arrival of rains in 2022 delayed Wheat and barley planting. Sowing in some areas was not completed until the end of December 2022. As of January 17, 2023, the industry estimated the total area planted for cereals for common Wheat, durum, and barley at 3.8 million hectares (HA), about 5 percent below the five-year average.

Post notes that although production has started with a below-average vegetation index, the upcoming rainfall during March and April is critical for crop development and will determine the success of the 2023 production campaign. Post’s production, supply, and demand estimate (PSD) for MY 2023/24 will be published in its Grain & Feed Annual Report on April 1, 2023.

Morocco Wheat Trade

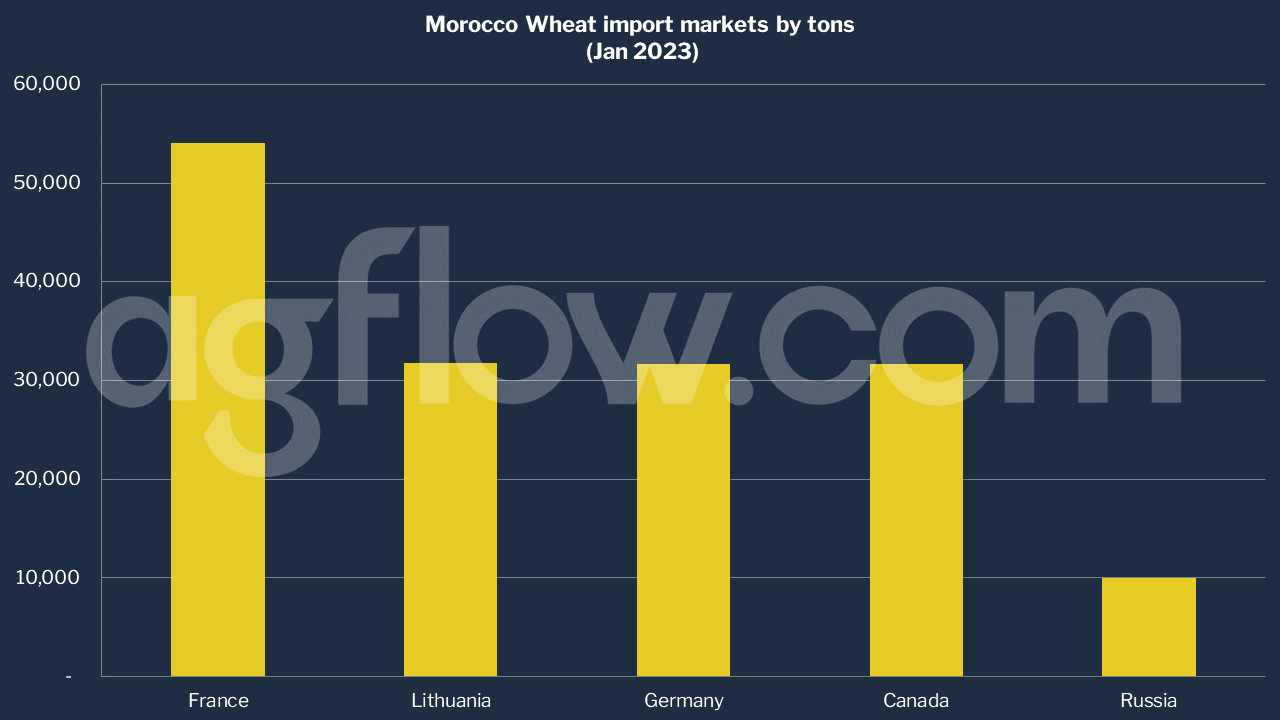

According to the AgFlow data, France led its import market with 54,100 tons of Wheat in the last month, followed by Lithuania (31,800 tons), Germany (31,700 tons), Canada (31,689 tons), and Russia (10,000 tons). Import volume totaled 2.6 million tons last year.

In 2020, Morocco imported Wheat worth $1.28 billion, becoming the world’s 11th largest importer of Wheat. In the same year, Wheat was Morocco’s 4th most imported product. Morocco imports Wheat primarily from: France ($396M), Canada ($312M), Ukraine ($196M), Russia ($90.4M), and Germany ($88.8M).

Other sources: USDA

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time