Poland, Hungary and Slovakia Continue Own Ban on Ukrainian Sunseeds

Talk to our team about AgFlow's offering →

Reading time: 2 minutes

Ukraine, often referred to as the ‘Breadbasket of Europe’, has long been recognized for its robust agricultural sector. But it’s not just about grains and wheat; Ukraine has carved out a significant niche in the global market with its Sunseed exports. But what factors have been shaping the Sunseed trade from January to August 2023? Let’s delve into the intricacies of this trade.

To begin, what is Sunseed? It’s more commonly known as sunflower seed, a critical agricultural product that provides the raw material for sunflower oil production, a key component in various culinary dishes worldwide.

Trade Dynamics in 2023

From January to August 2023, several elements have impacted the Ukraine Sunseed trade. First and foremost, global demand has seen a steady increase, especially from countries transitioning to healthier cooking oil alternatives. But has Ukraine been able to capitalize on this opportunity?

Balancing the Scales: Production vs. Export

Ukraine’s Sunseed production has experienced both blessings and challenges this year. On one hand, favorable weather conditions during the early months allowed for a promising harvest. However, internal infrastructural challenges, from transportation to storage facilities, have sometimes impeded the smooth flow of exports.

Now, imagine trying to fill a bathtub with a massive jug of water, but with a drain that’s half-clogged. The potential is there, but the outflow is hindered. Similarly, while Ukraine has the Sunseed, getting it to international markets in an efficient manner has posed challenges.

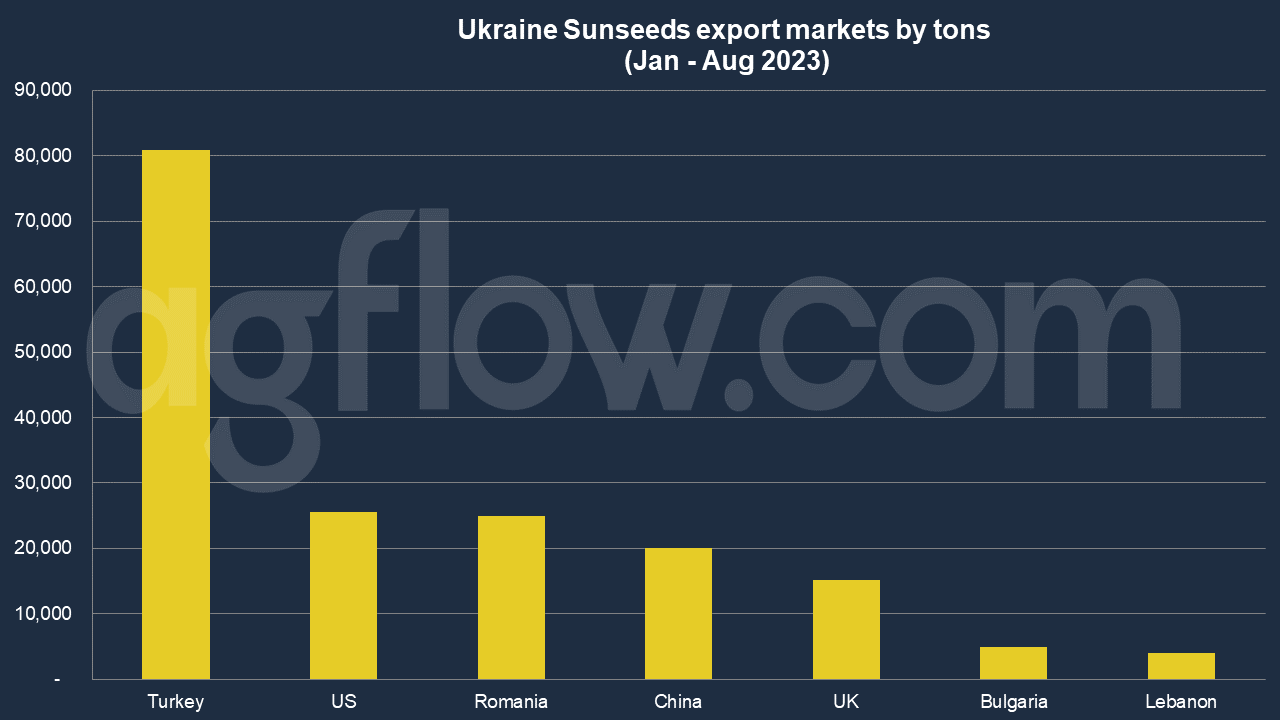

According to AgFlow data, Ukraine exported 0.18 million tons of Sunseeds in Jan – Aug 2023. Key markets were Turkey (80,945 tons), the United States (25,583 tons), Romania (24,949 tons), and China (20,000 tons), the United Kingdom (15,100 tons), Bulgaria (4,880 tons), and Lebanon (4,000 tons).

The EU Commission decided not to extend the ban on the import of Ukrainian agri-products to 5 EU countries after September 15. But Poland, Hungary and Slovakia unilaterally extended this ban. At the same time, export of Ukrainian Sunflower Seeds to Bulgaria and Romania will most likely resume in the near future.

Challenges and Trade-offs

What are these challenges, and what are their trade-offs? Increasing global demand means that prices are more attractive than ever. But meeting this demand requires investing in infrastructure, something Ukraine has grappled with, especially amidst global economic uncertainties.

But isn’t infrastructure investment a guaranteed return on investment, especially with surging demand? Here’s where the conundrum lies. Infrastructure requires time and money. By the time improvements are implemented, market dynamics could shift.

Exploring New Horizons

However, challenges often open doors to innovation. For Ukraine, the situation has nudged stakeholders towards exploring new trading partners, more efficient farming techniques, and even leveraging technology for better yield predictions.

And speaking of technology, have you ever considered the role of AI in agriculture? Imagine a scenario where AI predicts weather patterns, helping farmers optimize planting schedules. Or perhaps, drones equipped with sensors, assessing soil health, ensuring that every sunflower seed from Ukraine is of top-notch quality.

Conclusion

As we move towards the end of 2023, Ukraine’s Sunseed trade landscape is both exciting and challenging. The journey of a single sunflower seed from the vast Ukrainian fields to a kitchen halfway across the world is fraught with decisions, strategies, and sometimes, a bit of luck.

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time