What The Inverted Market Means if You’re Buying Argentina Soybean Right Now?

Reading time: 6 minutes

Argentina is the leading Soybean Meal & Oil exporter globally and strongly depends on its crushing industry facilities to produce the supply necessary to maintain the export pace. In early 2021, we highlighted the Argentina Soybean industry’s struggles, dealing with drought-induced lower supply, strikes in crushing facilities, and a tightening Soybean crush margin.

Additionally, Argentina is one of the top Corn exporters and is, therefore, one of the largest feed protein suppliers worldwide. Thus, Corn production also suffered from the strong La Niña effect, reducing the carry-out for the crop in 2021 to 48.5 Mmt, 2.5 Mmt less than the previous marketing year.

Despite these difficulties, Argentina managed to capture the inverted 2021 Agricultural market and recorded Year-Over-Year monthly exports growth for eight out of ten months so far, thanks to a good recovery of the Soybean crush margin in the latter part of 2021, as well as very price competitive and demanded feed products.

This means that Argentinian exporters still manage to handle the supply pace despite lower production volumes and persistent logistic issues. The fast-growing animal feed market allowed them to make record export sales thanks to high commodity prices, as well as year-on-year increasing export volumes.

Soybean Crush Margins, Corn Prices, and Record Exports Sales in 2021

At the beginning of 2021, the demand for Vegoils increased massively, with China lifting the global market. However, Argentina crushers need to monitor the crush margins made buying Soybean, as well as the profit generated selling Soybean Meal & Oil exports, in order to remain competitive and profitable.

Figure 1: Argentina Soybean Soymeal & Soyoil Spot Prices Between Jan & Oct 2021

Plot 1: Argentina Soybean Spot Prices

[/dica_divi_carouselitem][dica_divi_carouselitem button_url_new_window=”1″ image=”https://www.agflow.com/wp-content/uploads/2021/10/Argentina-Soybean-Meal-Spot-Prices.jpeg” image_alt=”Plot 2: US Wheat Import Origins” image_lightbox=”on” _builder_version=”4.11.3″ global_colors_info=”{}”]Plot 2: Argentina Soybean Meal Spot Prices

[/dica_divi_carouselitem][dica_divi_carouselitem button_url_new_window=”1″ image=”https://www.agflow.com/wp-content/uploads/2021/10/Argentina-Soybean-Oil-Spot-Prices.jpeg” image_alt=”Plot 2: US Wheat Import Origins” image_lightbox=”on” _builder_version=”4.11.3″ global_colors_info=”{}”]Plot 2: Argentina Soybean Oil Spot Prices

[/dica_divi_carouselitem][/dica_divi_carousel][dica_divi_carousel advanced_effect=”1″ _builder_version=”4.4.3″ global_colors_info=”{}”][/dica_divi_carousel]Soybean and Soybean Complex prices displayed in Figure 3 show that overall Soybean Meal spot prices went down despite a few surges in May, July, and September/October 2021. Simultaneously, Soybean prices remained strong as farmers were reluctant to sell to hedge against a weakening Peso (S&P Global Platts). The low supply available and the cost pressure thus reduced the crush margin significantly, as Soybean Oil prices were not enough to lift margins.

Figure 2: Argentina Spot Soybean Cash Crush Margin Between Jan & Oct 2021

The Spot Soybean Cash Margin displayed in Figure 2 was constructed using Argentina Soybean and Soybean Complex FOB prices, matching their issue dates and shipment periods. The curve reflects the solid Soybean prices and decreasing Soybean Meal’s. However, it shows that during the Parana River droughts, crush margins spiked as the demand for Soybean Meal surged (S&P Global Platts).

Read also: How China Feed Strategies Changed With Soybean Meal Prices

Figure 3: Argentina Soybean Meal Forward Curves by Month Emitted Between Jan & Oct 2021

The forward curves plotted for each month’s quotes in 2021 in Figure 3, show how the Argentina Soybean Meal market was inverted throughout the months and looks like it remains as such in October 2021 and beyond. Despite the thinning crush margins, Argentina managed to capture the inverted market, thanks to a growing global demand for meat and fish requiring increasingly more animal feed products.

Figure 4: Argentina Spot Corn Prices Between Jan & Oct 2021

Moreover, as the third-largest Corn exporter globally, Argentina saw the demand for its Yellow and Feed Corn increase. At the same time, Argentinian farmers also used the crop to hedge the Peso, leading to the price spike in May 2021, present in all plots from Figure 1, 2, and 4. As such, Argentina performed a record $9.5Bn in the first four months of 2021 (Reuters). Nonetheless, this demand was not driven solely by China.

Read also: Are Argentina Soybean Crush Exports at Risk?

Track Vessels Out of Argentina For 33 Commodities to 94 Destinations

Free & Unlimited Access In Time

Argentina Exporters Can Count On the Animal Feed Market

In January 2021, Argentina’s exports benefited from China moving away from Australia to source Barley as part of their animal feed strategy. Nonetheless, the record sales in the first quarter of 2021 were principally due to Soybean Meal and Corn exports.

Figure 5: Argentina Top 5 Commodities Monthly Export Volume Between Jan & Oct 2021

Figure 5 shows the top 5 commodities exported by Argentina, thus excluding Barley (as it is the 6th most exported commodity). The graph reveals that exports picked up strongly in April, with Corn MoM exports increasing by around 220%. Overall, Figure 5 shows that Argentina’s exports relied heavily on Corn and Soybean Meal. The graph also shows that the share of Soybean Oilseed exports has been growing over the months, confirming the local crushing industry’s struggles.

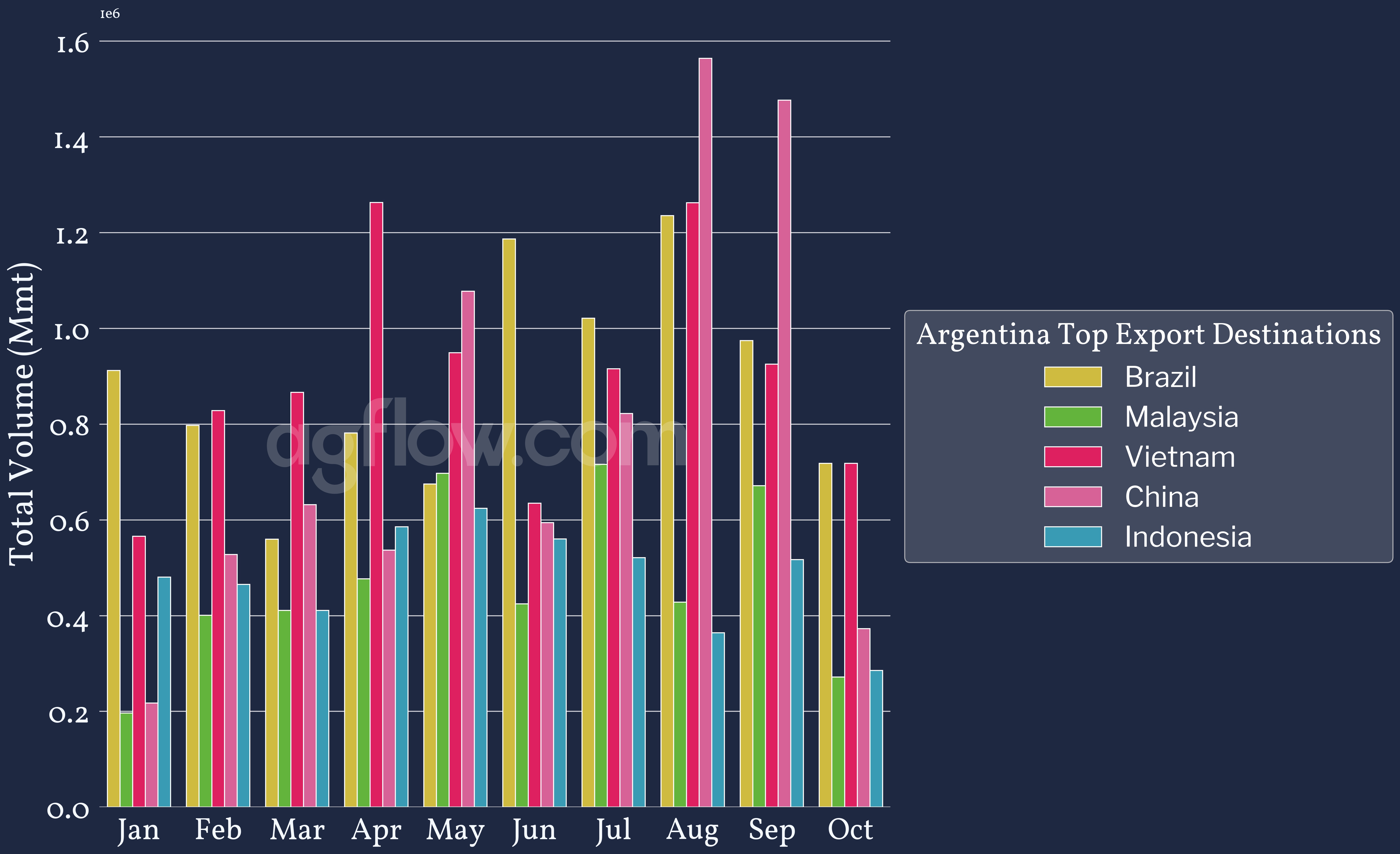

Figure 6: Argentina Top 5 Exports Monthly Volume by Destination

Between Jan & Oct 2021

Argentina exports rely on several destinations, as displayed in Figure 6. Vietnam is the top importer of Argentina agricultural products, with Corn and Soybean representing the great majority of Vietnamese imports destined to the fast-growing Vietnamese animal feed industry (thepigsite.com). Brazil also represents a large portion of agricultural exports, as it relies on Argentina Wheat, primarily for animal feed. Additionally, the rise of China imports is related to Soybean Oilseed exports, as China imports little crushed Soybean products and relies heavily on its crushing industry.

Therefore, Argentina exports relied heavily on essential animal feed components to fuel the large and growing animal breeding industry in key countries with established and trusted pipelines, the likes of Vietnam.

Read also: Are Traders Shipping Cargo On Larger Vessels Given the Dry Bulk Cargo Ocean Freight Rates?

Track Vessels Out of Argentina For 33 Commodities to 94 Destinations

Free & Unlimited Access In Time

In a Nutshell

In 2021, Argentina crops suffered from droughts caused by La Nina. The high demand for Soybean Oilseed and Oil—led by China—leveraged cash prices for these products globally and significantly reduced domestic crush margins in Argentina. The already struggling Soybean crushing industry also faced supply difficulties as farmers preferred stocking their productions to hedge a weakened Peso rather than selling. However, in the latter part of 2021, rising demand for Soybean Meal and logistics issues on the Parana river allowed margins to increase once more. Moreover, despite all the difficulties, Argentina performed record sales in the first quarter of 2021, thanks to high Grains, Vegoils, Oilseeds, and proteins prices.

Argentina also benefited from robust pipelines with industrial breeding countries, like Vietnam or Brazil, which massively increased their imports for animal feed products, allowing Argentina exports to surge. Additionally, China’s imports rose in 2021 as the country was looking for other Barley sources and contributing to Soybean Oilseeds exports increase while the Argentina Soybean crush industry was struggling.

Overall, Argentina profited from the bull market thanks to its products being more price-competitive than countries that depend more heavily on Chinese imports, such as the US or Brazil. As such, Argentina reported record sales and increased export volumes, thanks to growing breeding industries.

Read also: Feed – China: Hog Farmers Struggle With Prices Swing, And It Will Probably Last

3 Things Argentina Soybean Exporters Should Monitor Until the Next Harvest

-

Weather:

Forecasts predict another La Niña in 2021/22, which could impact Argentina crops significantly again, therefore they should a close look the strength of the weather effect the Winter which will inform their 2022 supply forecasts.

-

China:

The government recently announced it will reduce Pork herds to increase critically thin margins in the pork breeding industry. Since Argentina exporters rely more on Vietnamese and Brazilian imports, they will probably be less affected by China’s reduced feed imports and retain competitive prices against other origin products.

-

Argentina:

Exporters managed to perform well in 2021 despite low crushing efficiency and port logistics issues. Port logistics and crushing facilities capacity will need to be tracked closely as they will have an impact on crush margins and Soybean Meal prices.