Canada Leads by Far the Chilean Oats Import Market

Reading time: 2 minutes

Chile was the fifteenth largest global Oat import market, with values worth US$19.2 million as of November 2020, representing the most significant increase (72%) in the CAGR of the top ten global Oat markets as Chilean imports increased from US$2.2 million in 2016. Global Oat imports increased by a CAGR of 3.5% from 2016 to 2020. The United States (U.S) was the most prominent global market, with imports of Oats valued at US$569.2 million as of November 2020, representing a CAGR increase of 6%.

Within the South American market, imports of Oats experienced an enormous increase in growth of 21%, from US$50.8 million in 2016 to US$109.4 million in 2020. Notably, Chile was the third largest market for Oats, with imports of US$19.2 million.

Peru and Colombia were the largest importers of Oats in the South American market, with Peru importing US$ 31.4 million in 2020, while Colombia imported US$30.8 million as of October 2020.

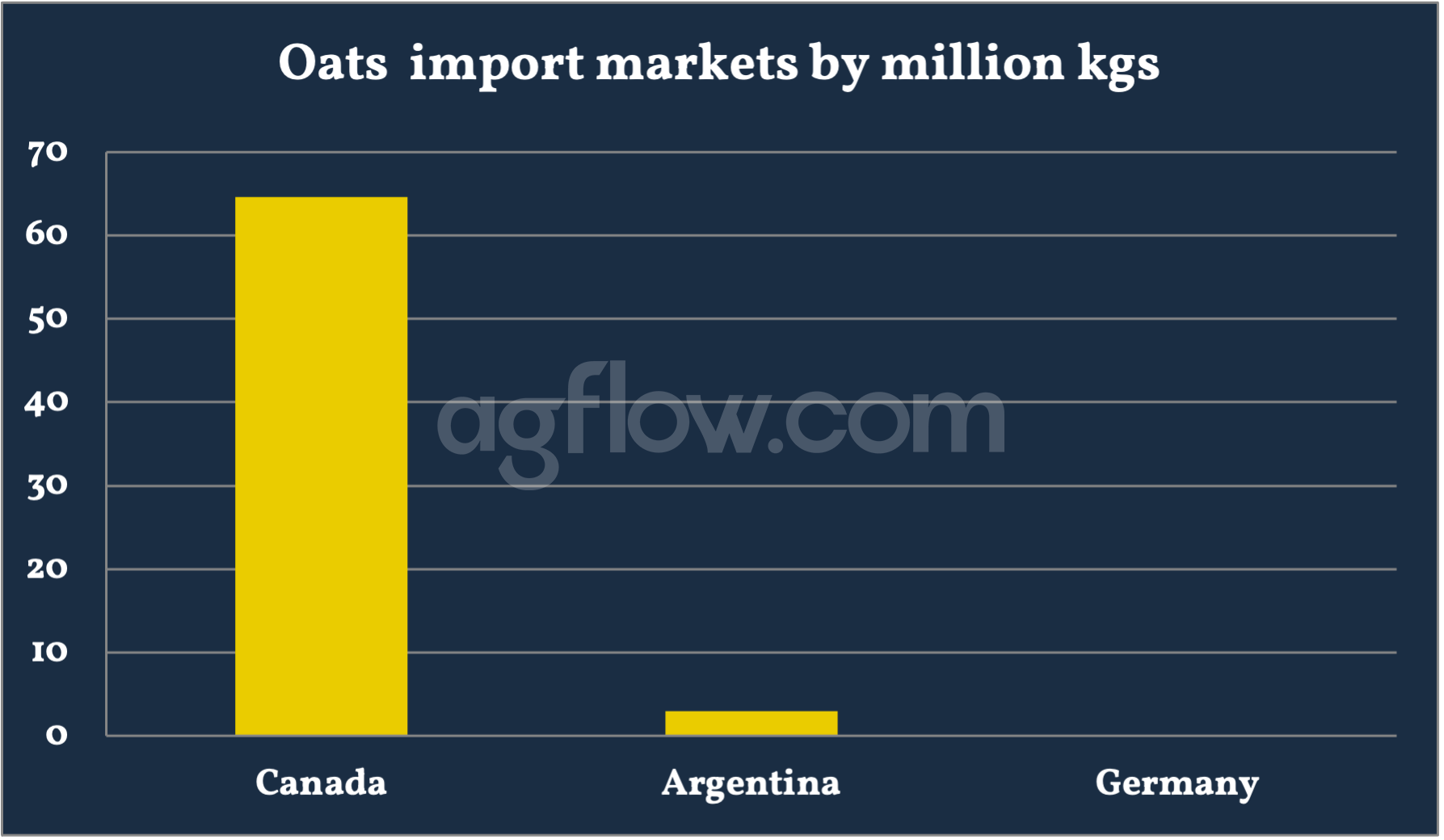

Chile has a diverse supply network of Oat providers. As of November 2020, Chile’s top three suppliers of Oats were Canada (US$18.2 million), Argentina (US$0.7 million, 3.0 million kilograms), and Germany (US$116,600; 134,975 kilograms). The volume of Oat imports from Canada increased by 70.6%, from 7.6 million kilograms in 2016 to 64.6 million kilograms in 2020 (November).

HS code 100490 (raw Oats excluding seed for sowing) represented the most prominent (98.3%) market share and experienced the largest growth (80.3%) during this same period. HS code 110422 (hulled, pearled, sliced, kibbled, or otherwise worked Oat grains) accounted for only US$0.2 million.

Chile’s Oat production totaled 638,000 tons in 2021-2022. Oat production in Chile has declined by a CAGR of 12.5% from the 2016-17 financial year to the 2019-20 financial year. Oat consumption in Chile has also reduced CAGR by 11.4% during the same period. In 2021-2022, global total Oats production was 25.4 million tons, while global consumption was 24.6 million tons.

Chile’s Oat Ingredient Food Market

Various packaged food products in the retail sector use Oats as a value-added ingredient. In 2019, retail sales of packaged food products in the bakery and cereals sector in the Chilean market were valued at US$7.2 billion, increasing at a CAGR of 2.9% from US$6.5 billion in 2015.

Retail sales of the top five categories (bread and rolls, cookies – sweet biscuits, morning goods, breakfast cereals, and savory biscuits) were US$6.8 billion in 2019 and tend to increase by 3.4% to US$8.5 billion by 2024 (pre-COVID-19 estimates).

The bread and rolls category recorded the most prominent retail sales with values of US$5.5 billion in 2019, followed by cookies -sweet biscuits (US$510.5 million), morning goods (US$298.8 million), and breakfast cereals (US$270.1 million).

In the breakfast cereals category, the ready-to-eat cereals segment attained the largest retail sales of US$193.3 million in 2019, an increase in CAGR of 2.1% from US$177.7 million in 2015. This segment obtains the largest CAGR of 5.9% in the forecast period, as retail sales will increase from US$210.6 million in 2020 to US$264.8 million by 2024.

Brand labels (99%) dominated the bakery and cereals sector retail market in Chile compared to private labels, representing 1% of the total market share in 2019. Convenience stores, hypermarkets and supermarkets, and food and drink specialists are the dominant distribution channels for bread and rolls, cookies (sweet biscuits), morning goods, breakfast cereals, and savory biscuits in Chile.

According to Mintel’s Global New Products Database, 217 products contained Oat (as an ingredient) launched as food, beverage, and pet products in Chile between January 2016 and December 2020.

Free & Unlimited Access In Time