How Biofuels & Weather Are Going to Impact Your Vegoils Trades In 2022

Reading time: 6 minutes

Global Vegoils markets in 2021 depended heavily on weather impacts. Major producers suffered from extreme weather conditions, which impacted the available supply of Oilseeds & Vegoils and changed the Vegoils market dynamics during the year. Following COP26 in November 2021, the interest for Biofuels – predominantly plant-based Biodiesels – exploded, leading to a change in the price dynamics of Soybean in the US in late 2021, and will continue to for other Oilseeds & Vegoils in 2022. Moreover, another La Niña is impacting South America with severe droughts and warmth, which will affect the Soybean supply in 2022. Yet, La Niña also contributed to Australia’s record Rapeseed crop in 2021/22.

How will the Biofuel industry and weather impact the Vegoils market trades in 2022?

In a rush? Jump to Conclusions now

Extreme Weather Is Shaping Global Vegoils Market Supply

The Vegoils market, much like other agricultural commodities, strongly depends on the weather during the growing season. However, the Oilseeds necessary to produce Vegoils are mainly produced in temperature-sensitive areas with strong weather effects, such as South America, Australia, or Canada. Thus, extreme conditions change the crop areas’ yield, production, and therefore crush volume.

Read also: Is the New 2022 Brazil Soybean Crop Going to Affect Your Trades?

Figure 1: South America Soybean S&D 2020/21 v. 2021/22 (Source: USDA)

Plot 1: Argentina Soybean S&D

[/dica_divi_carouselitem][dica_divi_carouselitem button_url_new_window=”1″ image=”https://www.agflow.com/wp-content/uploads/2022/03/Brazil-Soybean-SD-2022-v-2021.jpeg” image_alt=”Brazil Soybean S&D 2022 v 2021″ image_lightbox=”on” _builder_version=”4.14.5″ global_colors_info=”{}”]Plot 2: Brazil Soybean S&D

[/dica_divi_carouselitem][/dica_divi_carousel]South America Soybean S&D metrics for production and crush displayed in Figure 1 show that both Brazil and Argentina Soybean production volumes are expected to decrease in 2021/22 YoY. Despite having a solid start in Brazil with a faster planting pace than on average, the extreme droughts and heat due to La Niña are continuously depreciating growing conditions. Nonetheless, the crush estimate for Argentina is forecasted to only decrease by 162 kmt in 2021/22, representing about 0.4% of 2020/21 supply crushed. In Brazil, the Soybean crush estimated volume increases by 150 kmt YoY or a 0.3% increase. Therefore, despite lower expected production, the Vegoils market drives South America to maintain the same amount of Soybean Oil production. Similarly, extreme conditions reached Canada in Summer 2021, which directly impacted Rapeseed’s most significant global producer. For Canada Rapeseed analysis, we partnered with Prescient Weather, a US-based company providing crop-yield forecasts and weather information service with their CropProphet tool, as well as improved long-range weather & climate forecasts in the weeks and months ahead, World Climate Service.

Figure 2: Canada Rapeseed Yield Deviation From Trend per Year (Source: CropProphet)

The Rapeseed yield deviation featured in Figure 2 shows the deviation from the yield trend in Hectogram per hectares. Prescient Weather normalized the data by removing the technology trend, which biases the yield deviation trend, whilst displaying the top and bottom five years since 1960. Therefore, the normalized data relays that the variation is due mostly to weather. Using the highlighted years in Figure 2, they used the World Climate Service to check the temperatures in the months of June and July as well as the precipitation in order to correlate weather with yield trends.

Figure 3: Canada Temperature and Precipitation Anomaly in Jun 2021

(Source: World Climate Service)

From Prescient Weather’s analysis, temperature and precipitation anomalies in Canada correlated with Rapessed yield deviation trends in different ways. Warmer and drier years were correlated with negative yield deviation, while cooler and slightly wetter years correlated with positive yield deviation. Therefore, the hot and dry conditions observed in Summer 2021, displayed in Figure 3, are related to high negative yield deviation, and thus, low production.

Read also: Where to Source Soybean & Other Feedstocks for Biodiesels & Renewable Fuels

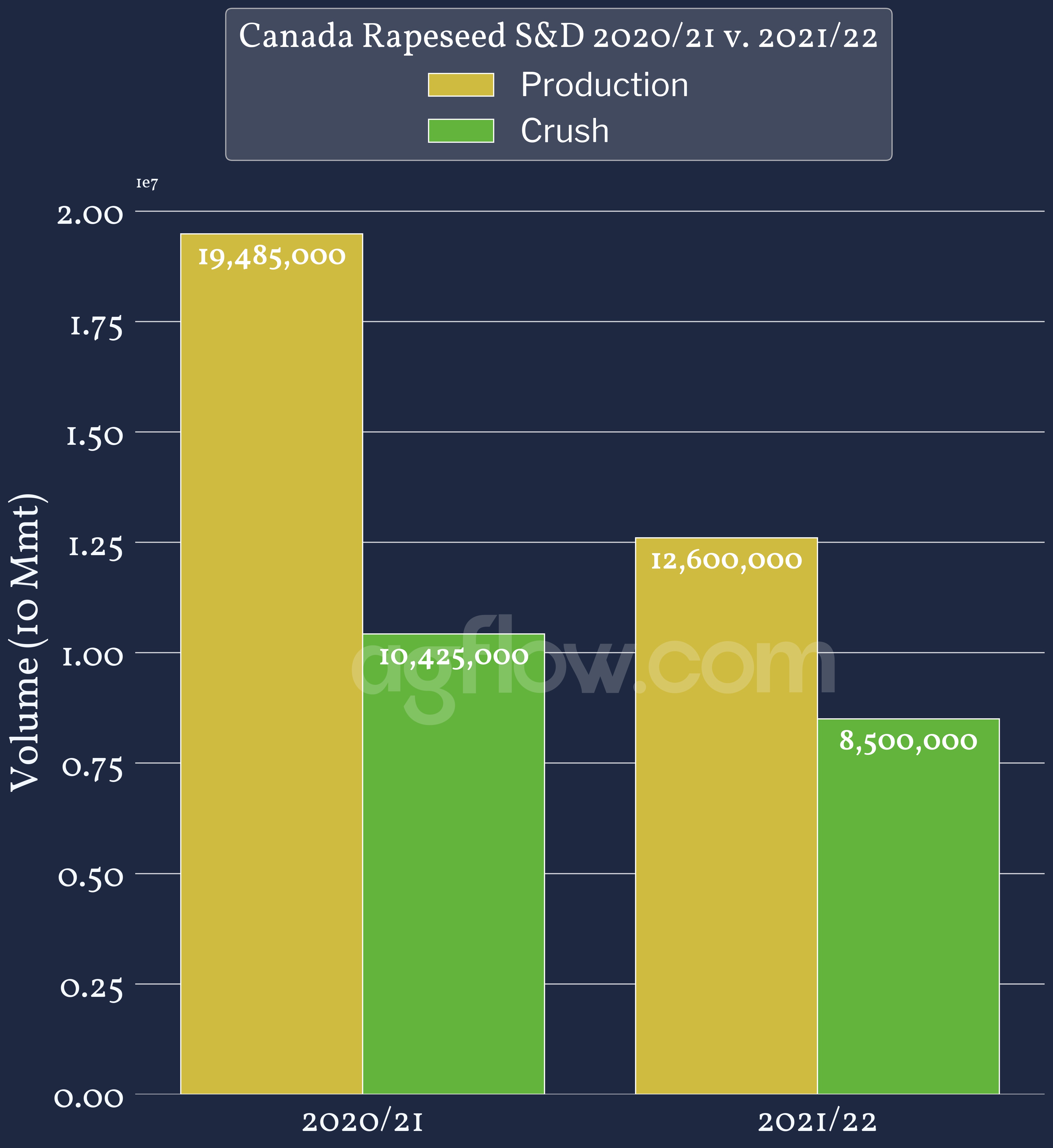

Figure 4: Canada Rapeseed S&D 2020/21 v. 2021/22 (Source: USDA)

Consequently, the Canada Rapeseed production and crush estimates plotted in Figure 4 show that 2021/22 production decreased by around 35% YoY. However, Rapeseed crushing only reduced by approximately 18% in comparison. This indicates that while the Rapeseed production heavily decreased, the market is still in dire need of Rapeseed Oil. Furthermore, Canada expects to plant less Rapeseed in 2022 (Syngenta), which will reduce the supply available at export. With the rising demand for Biodiesels, the market dynamics are shifting towards other producers due to poor conditions in leading producing countries, including Canada.

Reach 15 AgFlow Contributors Providing Information on 26+ Feedstocks

Free & Unlimited Access In Time

Biofuels Are Changing Vegoils Market Trade Dynamics

Previously in 2021, we highlighted the dynamics in the US Soybean market coming into 2022, mentioning how US Soybean Oil S&D and cash prices were starting to drive the market in late 2021 and coming into 2022. The Biofuels market is also affecting trade dynamics in Europe. Rapeseed is the primary Vegoils used for Biodiesels production in Europe, and with the disappointing Canada Rapeseed crop in 2021, exports fell rapidly (Mintec), hitting a 14-year low. Consequently, European countries had to diversify their sources.

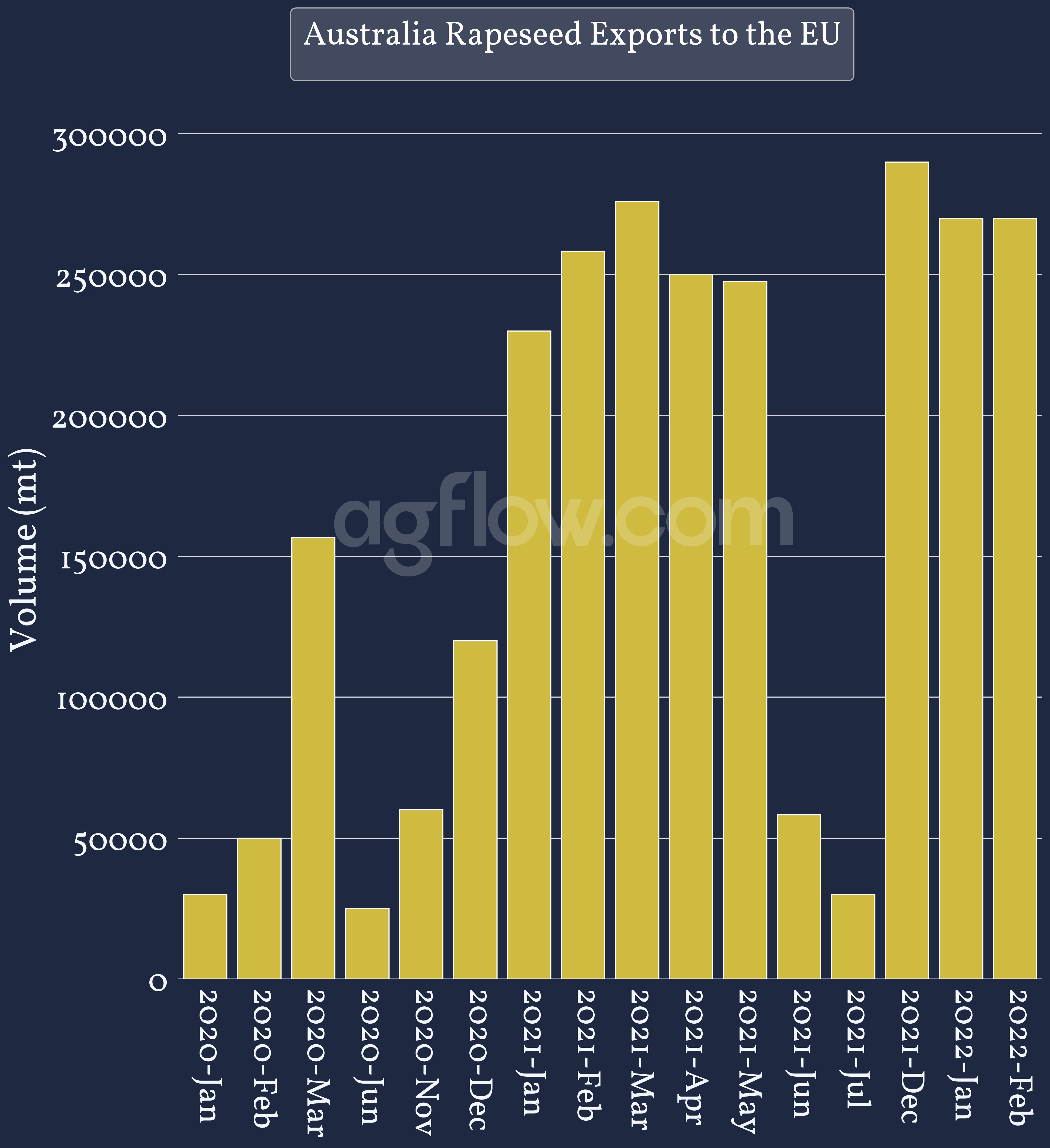

Figure 5: Australia Rapeseed Trade Flows to the EU Between Jan 2020 & Feb 2022

Australian Rapeseed monthly export volumes to the EU featured in Figure 5 show that exports dramatically increased in January 2021, with an even greater increase in 2022 with the new Rapeseed crop beginning in December 2021. This is a signal that the EU is in strong demand for Oilseed, particularly to produce the Vegoils for Biodiesel.

Figure 6: Canada Rapeseed Year-On-Year Growth by Month

The export volume growth displayed in Figure 6 shows that exports skyrocketed in January and February YoY. Even the month of March, which was the largest export month in 2020, saw substantial growth YoY as well. Additionally, Palm Oil in Indonesia and Malaysia, the largest produced Vegoils globally, faces structural challenges post-Covid 19. Therefore, Indonesia and Malaysia will produce and export less Palm Oil in 2022 (Reuters). Moreover, Biofuel demand in China, Brazil, or even the US could affect Palm Oil supply distribution (Reuters), change pricing dynamics in the Vegoils market, and add even more pressure to other Vegoils like Soybean Oil or Rapeseed Oil.

Read also: What Should You Expect From The US Soybean Crop in 2021/22?

Track Oilseeds & Vegoils Vessels

From Up to 37 Origins

Free & Unlimited Access In Time

In a Nutshell

Extreme weather conditions in South America and Canada arose due to La Niña in 2021, leading to lower Oilseeds production in Argentina, Brazil, and especially Canada, where Rapeseed production decreased by 38%. Despite this change, crush estimates almost did not change, thus showing the growing interest for the Vegoils market.

Additionally, the growing Biofuels market is shaping the pricing of Soybean in the US, as the distribution of the supply in 2022 is balancing lower exports with more crushing and Soybean Oil production, thereby changing the market dynamics. Moreover, the low Canada Rapeseed production pushed the EU to diversify its pipelines and massively increased imports from Australia for its growing Biofuels industry.

All in all, La Niña in 2022 is affecting the production of Vegoils in South America and is likely going to affect the output of Rapessed in Australia and Canada. Moreover, with the workforce issues and heavy rains in Indonesia & Malaysia, Palm Oil production and exports will pressure Soybean and Rapeseed markets even further thanks to Biodiesel driven exports.

Need more insights? Jump back to start