Is the New 2022 Brazil Soybean Crop Going to Affect Your Trades?

Reading time: 6 minutes

Brazil Soybean planting of the 2021/22 crop happened swiftly and finished in Q4 2021 to curb the droughts of a second La Niña following the one during the Southern Winter 2020/21. The side effect of this early planting – the crop will also be on the market sooner, competing with the US crop at total capacity earlier than it usually does. China is the main competition stage for both origins, but the US will be relying less on exports in 2021/22, and China is expected to decrease imports of the Oilseeds. Are these going to affect Brazil Soybean trade dynamics in 2021/22?

Is the Fast Planting Driving Brazil Soybean Into Bear Market?

In Q4 2021, Brazil benefited from excellent conditions while planting the new Soybean crop. On November 29, 2021, farmers completed more than 90% of Soybean planting (Safras & Mercado), higher than the 5-year average by 5.1%. Although the conditions were ideal, this was also due to an effort to curb the La Niña effects. This led analysts to forecast a record crop for Brazil Soybean, which decreased Cash Market prices.

Read also: How Is the Brazil Soybean Cash Market Structured during the 2021 Harvest?

Figure 1: Brazil Soybean FOB Spot Cash Prices Between Jul 2021 & Jan 2022

Brazil Soybean FOB Spot prices displayed in Figure 1 show that prices from September 2021 onwards decreased as crop reports forecasted a record crop. Moreover, the fast Soybean planting in Q4 contributed to the bear market trend (Brownfield Ag News), with prices reaching their minimum in mid-November. Nonetheless, adverse conditions arising in December contributed to prices increasing until now, in January 2022. Moreover, recent tensions in the Black Sea could lead to Russia being banned from SWIFT transactions, and bullish January reports are bolstering prices in late January 2022.

Figure 2: Brazil Soybean FOB Forward Pricing From Mar to Aug 2022

Brazil Soybean forward cash prices in Figure 2 show that so far, the Soybean market is in contango in 2022. This is due to the market pricing the carry of the commodity, as a large quantity of Soybean will be available at export, suggesting potential logistics difficulties. As China buyers locked in most of their Soybean in December, contributing to the rally in spot prices, Brazil will have to ship large quantities early in the marketing year. This, in turn, could change pricing towards an inverted market.

However, China announced its intention to import less Soybean in 2022 than it did during the previous year, consistent with its plan on improving Oilseed self-sufficiency (Farm Weekly), which could impact Brazil Soybean exports and continue pricing a contango market.

Access +12k Monthly Soybean Cash Prices From Brazil, the US, and 13 Other Origins

Free & Unlimited Access In Time

Is China Going to Sweep Up the Brazil Soybean Supply Again in 2022?

The Brazil Soybean market depends strongly on exports, in which China plays a crucial role. In 2020 China was the primary destination for Brazil Soybean exports, and in 2021 it contributed to the global bull market by sweeping up Oilseeds and Grains worldwide.

Read also: What Should You Expect From The US Soybean Crop in 2021/22?

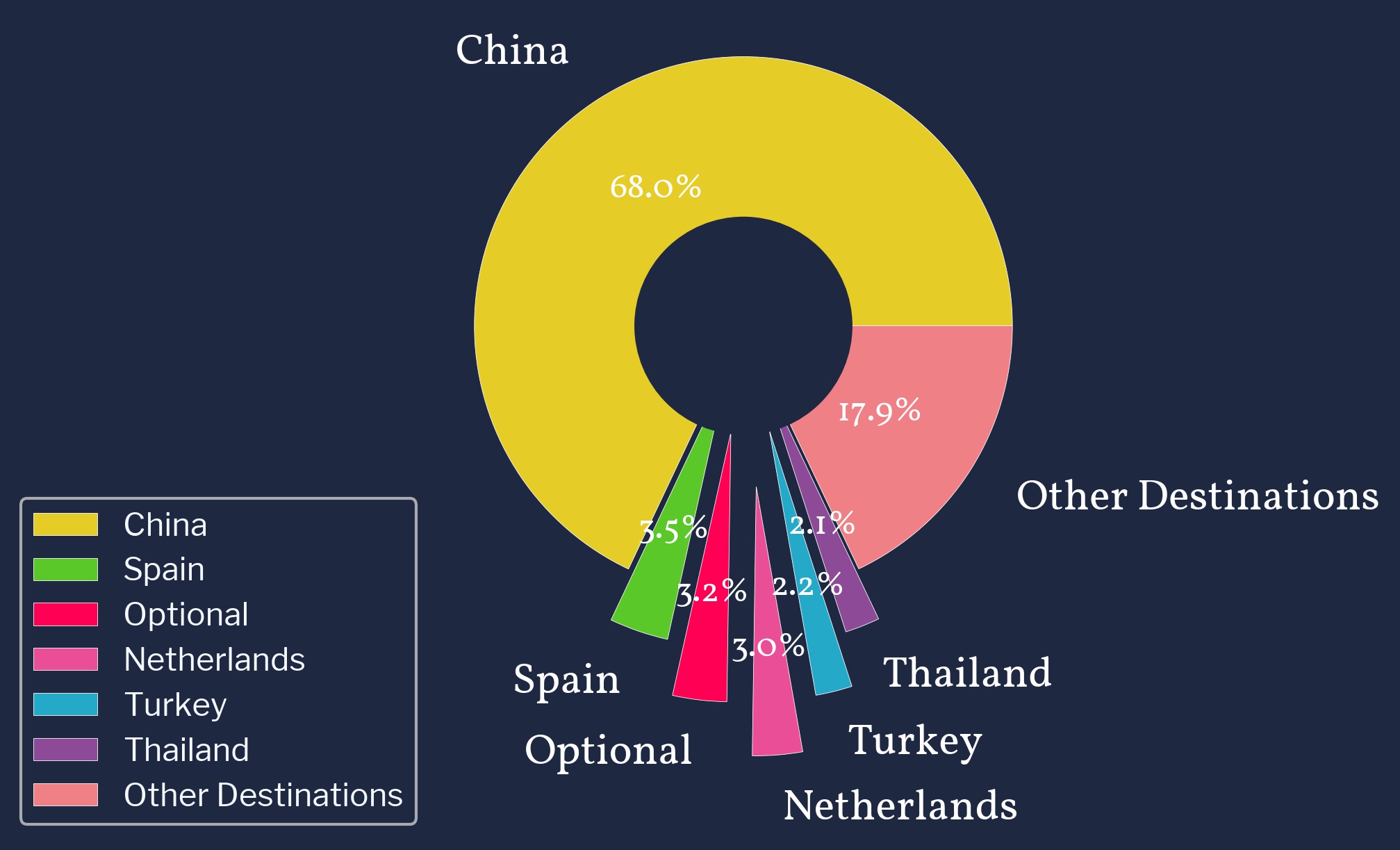

Figure 3: Brazil Soybean Export Distribution In 2021

The distribution of Brazil Soybean exports shows that China represented 68% of the Brazil Soybean export market in 2021, while the second-largest unique market was Spain, representing 3.5% of all Soybean exports. From the distribution, Brazil has a strong pipeline towards the EU market as Spain and the Netherlands represent 6.5% combined. However, the share of other destinations (less than 2% individually) represents almost 18% of the Brazil Soybean export market.

Figure 4: Total Brazil Soybean Exports Between Jan & Dec 2021

Brazil Soybean monthly exports in 2021 displayed in Figure 4 show that the crop is highly sought after early in the marketing year starting in February. In 2021, exports increased rapidly in March, peaked in April, and then steadily decreased over the following months. However, due to the earlier harvest in 2022, this pattern should shift ahead and could probably peak in March.

Chinese buyers booked shipments in December 2021 and early in January 2022 for February and March delivery, but they could still cancel shipments depending on the crop harvest. Moreover, with China probably importing less Soybean this year, exports could be re-balanced over late Q2 and Q3 2022. Nonetheless, China Soybean Meal stocks are almost at a 2-years low, and with the Chinese New Year and Olympic games cumulated, this could spark more imports (Brownfield Ag News) in February and March 2022.

Track Soybean & Soybean Complex Vessels From Brazil to China, Thailand, & Up to

58 Other Destinations

Free & Unlimited Access In Time

In a Nutshell

Brazilian farmers planted Soybean at a faster than average pace in Q3 & Q4 2022 thanks to ideal weather conditions and as part of an effort to try to curb La Niña droughts effects during growth. This led to a bear spot cash market as reports forecasted a record crop for Brazil in 2022. However, this also induced a contango market, as the swift planting pace will make more of the Soybean crop available earlier, which could lead to logistics issues, thus increasing carry costs. Moreover, Chinese buyers who booked shipments in December & early in January could cancel them, depending on the crop results.

Brazil Soybean exports depend on China, representing 68% of the export market in 2021. The marketing year starts in February, and most Soybean shipments happen between March and May as soon as the crop is available. However, due to Soybean planting completion early in Q4 2021, the 2021/22 crop will be available ahead of the usual time, probably shifting the export pace as well. This plays in the hand of Chinese buyers, who could buy more Soybean due to the Chinese New Year and the overlapping Winter Olympic games boosting consumption. Nevertheless, with early buyings uncertain to follow through and lower expected Soybean imports, China will likely occupy a less than usual importance in Brazil Soybean exports, however only by a small margin.

All in all, Brazil’s strategy to finish Soybean planting early will certainly pay off by having a record crop in 2021/22. However, this also shifts the market pricing and dynamics and disturbs logistics pipelines that could ultimately hamper exports. Although China will probably be less important for the Brazil Soybean export market in 2022, it will remain its most significant part. Therefore, Brazil Soybean exports will have to rely slightly more on other destinations to sell its crop in the second part of 2022.

Read also: Where to Source Soybean & Other Feedstocks for Biodiesels & Renewable Fuels

3 Potential Growing Markets for Brazil Soybean

The EU and Biofuels demand:

With Spain and the Netherlands as two important existing pipelines for Brazil Soybean, the EU demand could arise amidst a shortage of Palm Oil and a growing demand for Biofuels feedstocks.

South-East Asia:

South-East Asia is a large Soybean consuming region. Thailand is already in demand of Brazil’s Soybean products, and Vietnam requires more and more Soybean Meal for its growing livestock industry. While Brazil primarily exports the full raw product, it will be one of —if not the most— competitive Soybean crops globally in 2022.

Global Biodiesel Feedstock demand:

Brazil is currently the largest producer of Bioethanol globally, and is sitting on the largest Soybean crop. As such, it could further develop its Biodiesel industry. However, other regions like North America, the EU, Northern Asia, and the Middle East are developing the industry, which could change Brazil Soybean export dynamics in the years to come.