What Should You Expect From The US Soybean Crop in 2021/22?

Reading time: 6 minutes

In its latest WASDE issue of November 2021, the USDA reviewed the US Soybean crop carry down from the previous report, balanced out by lower exports. The 2021/22 marketing year for US Soybean differs from previous years. It is reshaping around a lower Chinese demand and a fast-growing Biodiesel and Renewable Fuels global market, which depends strongly on Soybean Oil. In addition, current issues in logistics due to global freight congestion in ports were accentuated in the US when Hurricane Ida shut down the Gulf export area in late August 2021. This will lead to fundamental changes on the US Soybean market in 2021/22.

This means that the US Soybean market is reshaping around a more important domestic demand for crushing, and lower exports directly linked to lower Chinese demand.

How Is the Soybean Crop Supply Shaped in 2021/22?

The US Soybean crop supply breakdown is available ahead of harvest thanks to USDA’s supply and demand data. It provides crop volumes for the total supply, domestic demand, crush, and exports. Using those parameters provides an overview of the crop supply in the current marketing year.

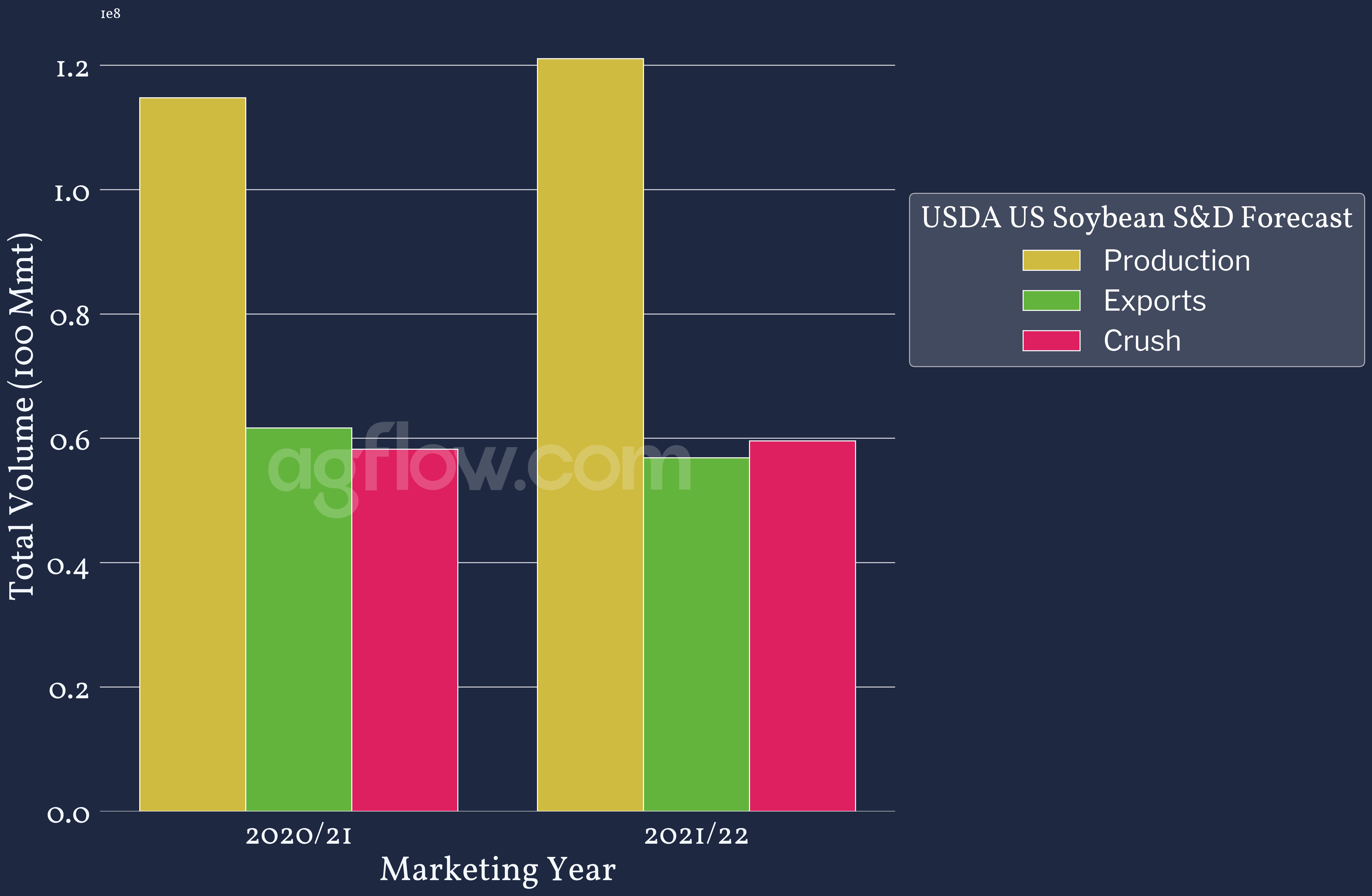

Figure 1: US Soybean S&D Forecast by Marketing Years 2020/21 & 2021/22

USDA’s data for US Soybean marketing years 2020/21 and 2021/22 in Figure 1 reflect on the one hand diminishing exports and on the other hand an increase in Soybean Oil demand. In 2021/22, the US Soybean crop production increased by +6 Mmt compared to the previous marketing year, partly thanks to a record yield. Additionally, although it was adjusted in the latest report, the volume of the crop dedicated to crushing increased compared to the previous marketing year.

Read also: Soybean – Brazil: USDA Forecast A Record Brazil Soybean Crop, Could La Nina Thwart it?

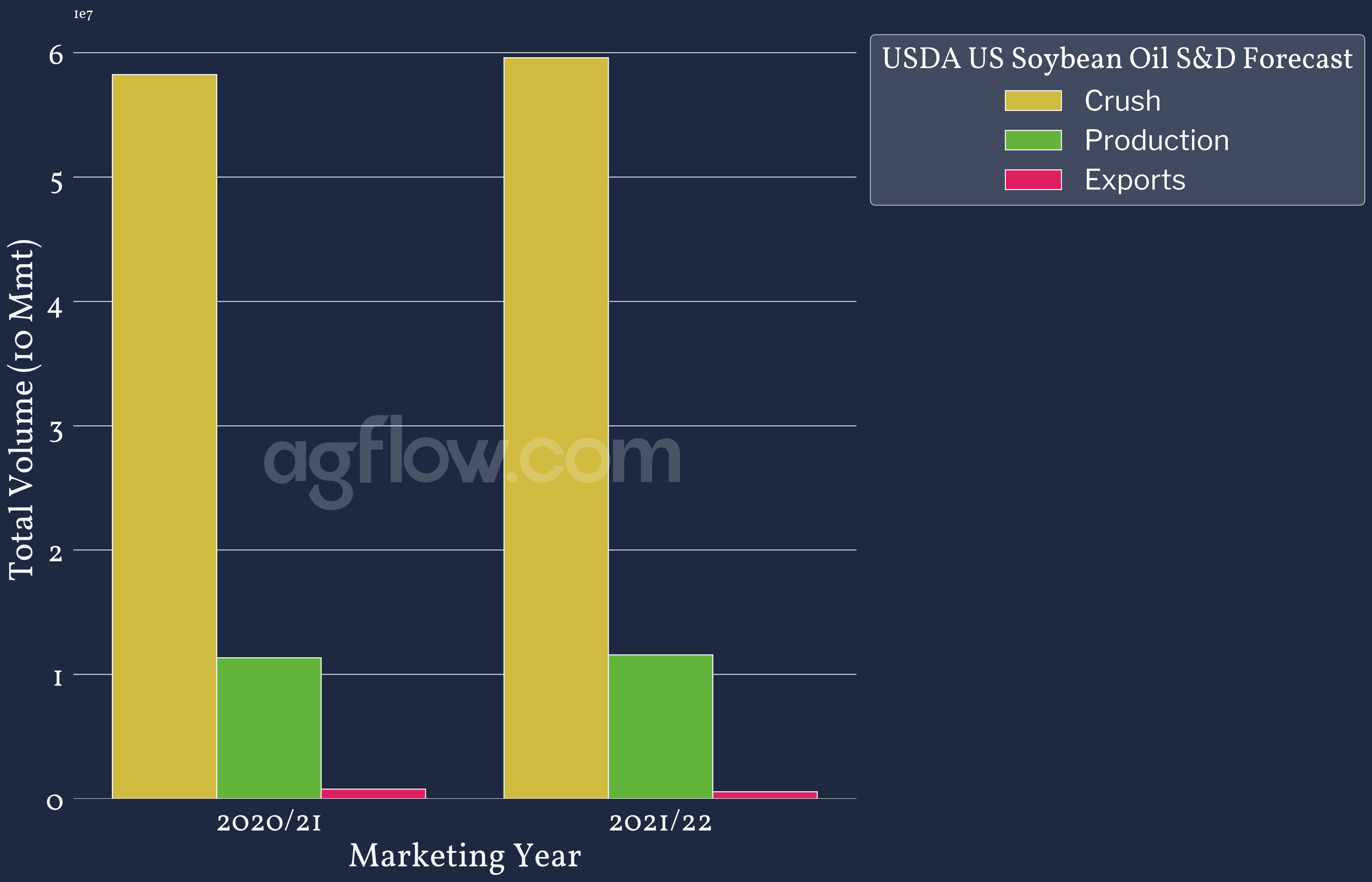

Figure 2: US Soybean Oil S&D Forecast by Marketing Years 2020/21 & 2021/22

USDA’s Soybean Oil data in Figure 2 indicates that the demand for Soyoil is predominantly domestic, as exports represent only 5% of the expected production. Additionally, production is expected to increase in 2021/22, supported by stronger demand in the Biodiesel and Renewable Fuels sector (biodieselmagazine.com). This change in 2021 is mainly due to US policies promoting the industry, which contributed to US Soybean Oil prices rising while Soybean Meal prices, the primary product of Soybean crushing, tumbled due to low demand (farmprogress.com).

Figure 3: US Gulf Yellow Soybean FOB Spot Prices Between Sep 2020 & Nov 2021

Additionally, US Yellow Soybean FOB spot prices displayed in Figure 3 reflect the uncertainty sparked by droughts in the US which started in Q1 2021, and shipment issues in Brazil leading to an increase in Brazilian prices. However, by the end of July 2021, the crop supply forecasts began to shape the final volumes, giving bearish signals due to the large crop size. Moreover, Chinese demand for Soybean decreased throughout the year, which bolstered prices early in the marketing year and contributed to the decrease in Q3 2021. Additionally, export issues due to Hurricane Ida also influenced US Soybean prices to drop.

Read also: What The Inverted Market Means if You’re Buying Argentina Soybean Right Now?

Access 33k Soybean & Soybean Complex Monthly Cash Prices from the US, Brazil,

and up to 27 Other Origins

Free & Unlimited Access In Time

What Does China’s Expected Lower Demand Mean for Us Soybean Export?

China is the largest importer of agricultural products globally and the first importer of US agricultural goods, including Soybean. In Q4 2020, US Soybean exports to China were boosted by China’s growing demand for feed products and the Phase 1 deal between the two countries.

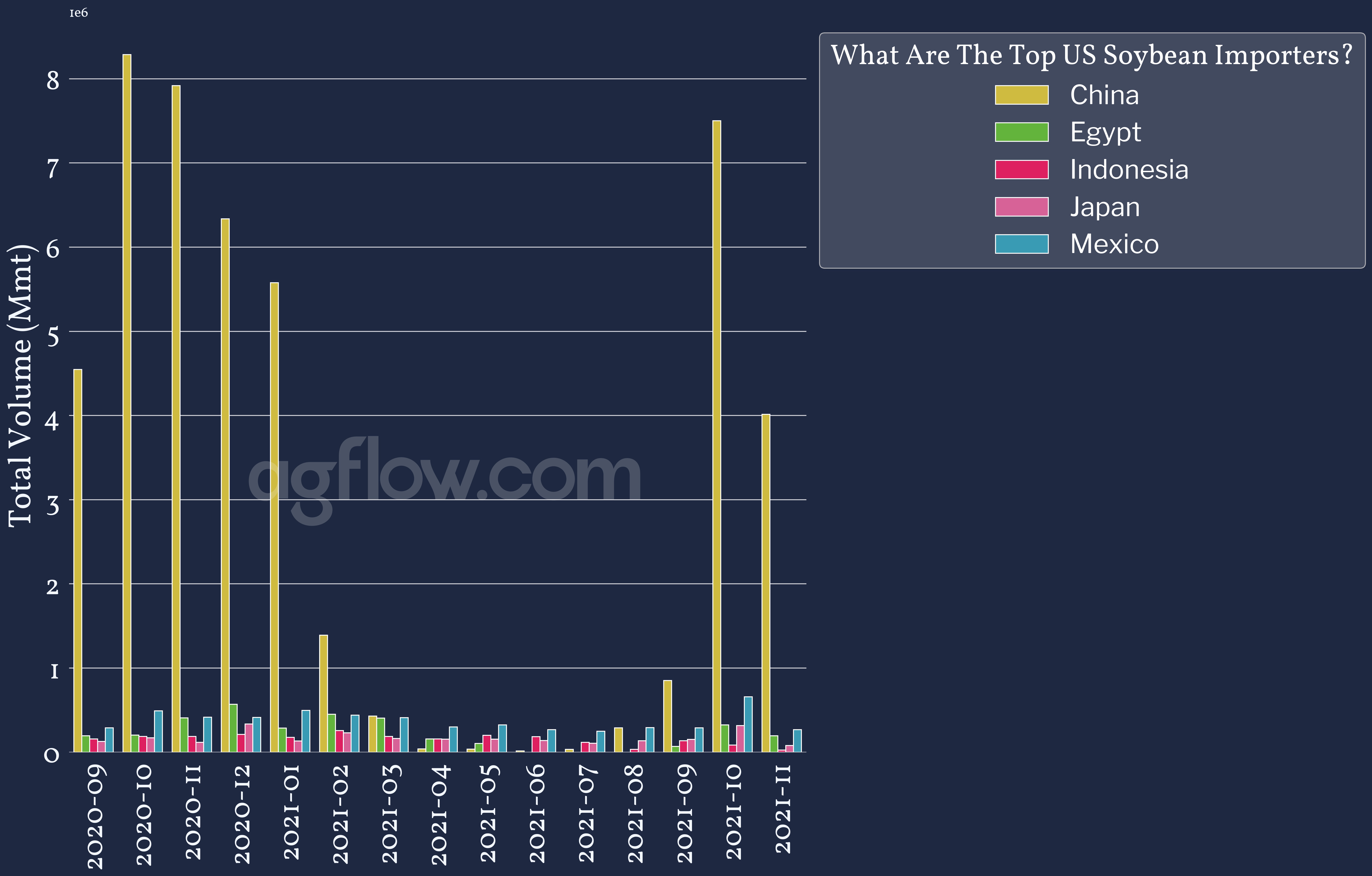

Figure 4: US Soybean Export Volumes by Destination Between Sep 2020 and Nov 2021

However, in 2020/21, Chinese Soybean imports from the US decreased progressively and were even below Mexico, Egypt, Indonesia, and Japan between April and July 2021. This is because China produces most of its Soybean Meal domestically. Domestic Soybean Meal prices surged with feed demand, and the surge of US Soybean prices between April & June 2021, seen in Figure 3, contributed to create extremely tight cash domestic Soybean crush margins. Since other commodities like Wheat and Barley were cheaper, feed mixtures for Chinese pork herds included more of those while China imported more Soybean from Brazil as it was more affordable than the US crop.

This also sparked uncertainty about whether China will complete its agreement with the Phase 1 trade deal, as its demand for US Soybean and Corn wanes to reduce its pork herds sizes (farmprogress.com).

Read also: Feed – China: Hog Farmers Struggle With Prices Swing, And It Will Probably Last

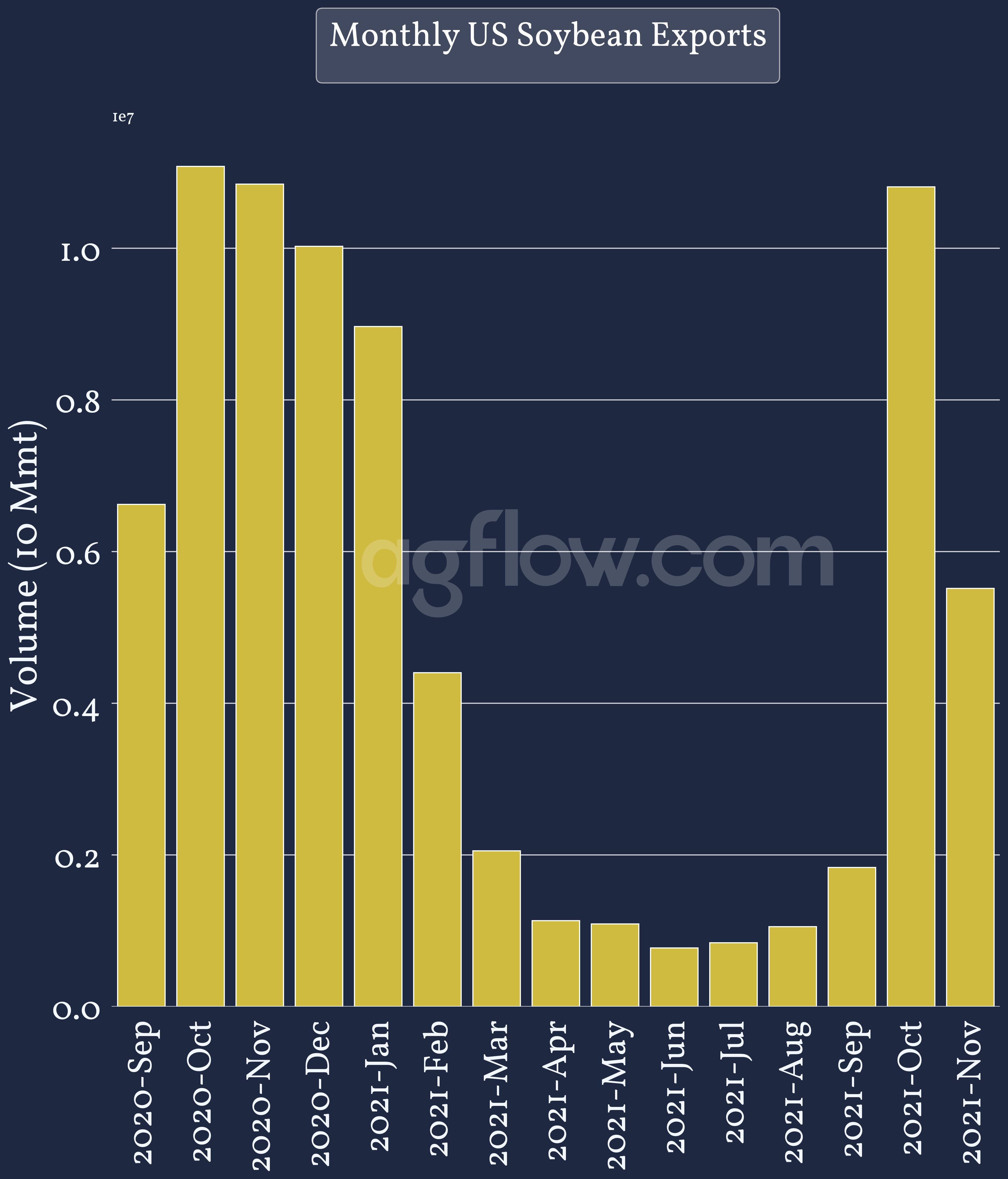

Figure 5: US Soybean Exports Between Sep 2020 and Nov 2021

The total US Soybean exports over MY 2020/21 (September 2020 to November 2021) in Figure 5 show that the US relies primarily on China. Therefore, Chinese demand has alternately increased and hampered US Soybean exports during MY 2020/21. Nonetheless, while the Chinese market retreated in Q2 2021 onwards, it grew overall in the marketing year thanks to its large imports in Q4 2020. Moreover, other export markets grew in 2020/21 and could be a source of diversification for US Soybean Exports.

Figure 6: US Soybean Top Growing Export Markets In 2020/21 v. 2019/20

The top growing export markets for US Soybean in Figure 6 are not the top 5 markets displayed in Figure 4, with the exception of China. While the most significant percentage growth is France at first sight, it only represents an absolute volume increase from 38.6 kmt in 2019/20 to 140.7 kmt in 2020/21. The most impressive market growth comes from Vietnam, considering absolute volumes, besides China. Moreover, Vietnam relaxed its duty on US agricultural goods, including Soybean (Brownfield News), probably to support its rapidly growing livestock industry. Therefore, it might become a top export market for US Soybean in 2021/22.

Track +1.3k Soybean & Soybean Complex Vessels Monthly to China, Vietnam, and

76 Other Destinations

Free & Unlimited Access In Time

In a Nutshell

US Soybean did not suffer as much as Winter and Spring crops in the US, such as Wheat. As the 2020/21 season progressed, the spot pricing of the crop evolved, surging in Q2 2021 due to a growing concern induced by droughts. However, the crop came out strong with record yields and production, leading to continuous cash prices’ decrease.

Moreover, USDA crop forecast reports showed that although the crop was large, the total US Soybean export volume is expected to decrease due to a lowered Chinese demand, driven by its effort to reduce pork herds sizes. On the other hand, the fast-growing Biodiesel & Renewable Fuel industry is also driving the domestic crush demand, increasing YoY, leading to rising Soybean Oil prices.

The diminishing Chinese demand and logistic issues aggravated by Hurricane Ida, closing the Gulf export area in late August 2021, also decreased prices. Therefore, these factors contributed to creating a significant discrepancy in trade flows between 2019/20 and 2020/21, with many of the top export destinations’ market’s export volume declining.

Nonetheless, other US Soybean export markets managed to grow throughout the year, such as Canada, South Korea, and Vietnam. In addition to this, Vietnam reduced its duty on US agricultural products, showing the will to increase its share of US agricultural imports, including Soybean.

Read also: Here’s Why US Agricultural Exports Have Decreased in August 2021 v. August 2020

3 Things You Should Track Coming Into 2022 if You Have Stakes in the US Soybean Crop

-

Brazil & Argentina Soybean Crops:

Brazil and Argentina started planting their 2021/22 crop earlier this year and at a much faster pace than on an average year, profiting from excellent early conditions to curb La Niña during the Summer in the Southern Hemisphere. Early crop reports forecast excellent to record crops so far, which would compete earlier on the market thanks to the planting schedule.

-

Biodiesel & Renewable Fuels Demand:

The Biofuels industry is rapidly growing thanks to national and international policies, favoring the development of these fuels over conventional ones. As Western and Asian countries will continue developing this industry, the demand for vegoils, and particularly Soybean Oil, will increase for this sector.

-

Livestock Feeding Industry:

While the Chinese pork industry is slowing down, other producers like Vietnam are expanding their livestock production, relying on Soybean meal. Additionally, China is also balancing livestock production as the poultry production is increasing, and US exports show signs of regrowth with China. As such, the demand for Soybean and Soybean Complex products might increase in 2021/22 and in the years to come, albeit another Swine Flu or Avian Influenza outbreak.