China Wields $40B Soybean Import Demand as Trade Chip

Reading time: 4 minutes

By John W. Miller, Trade Data Monitor.

It is China’s exploding wealth, rising middle classes, and expanding appetite for meat that make it the world’s top purchaser of soybeans.

In 2020, China imported 100.3 million tons, worth $39.5 billion, of the legume, which is a key ingredient in making soybean meal as feed for swine. That was almost double the amount of 54.8 million tons, worth $25.1 billion, it imported a decade ago, in 2010.

Even as a recent resurgence of African swine flu in its pig population threatens to dent demand for the soybeans the hogs eat, there’s no chance China will lose its position as the world’s dominant buyer of soybeans.

In 2020, it imported almost twenty times more than the second-place country, Mexico, which shipped in 5.7 million tons of soybeans in 2020. Next were Argentina (5.7 million tons), Thailand (5.3 million tons), and Egypt (4 million tons).

Figure 1: Global Imports from World Commodity

Source: Trade Data Monitor

Source: Trade Data Monitor

Source: Trade Data Monitor

Source: Trade Data Monitor

Source: Trade Data Monitor

Source: Trade Data Monitor

In changing up sources of imports, mainly between the U.S. and Brazil, Beijing is able to maintain supply, lower prices through competition, and negotiate better trade terms, according to an analysis by Trade Data Monitor, the world’s top source of trade statistics.

For example, in the first two months of 2021, China almost doubled its imports from the U.S., to 12 million tons from 6.1 million tons. At the same time, it cuts shipments from Brazil to 1 million tons from 5.1 million tons. This was partly due to a devastating rainy season in Brazil that hurt production, but it was also a political decision to repair a trade rift with the U.S. by ramping up agricultural purchases.

China’s organic hunger for soybeans, built on the demand of a population of 1.4 billion, and its centrally-planned economy make its soybean buying power an important chip in trade and diplomatic negotiations.

There are two main suppliers to Beijing: Brazil and the U.S., the world’s top two overall soybean exporters. The two agricultural superpowers have different growing cycles. Brazil harvests soybeans in March, and the U.S. harvests in October and November, but it is useful and relevant to compare shipments over an entire year.

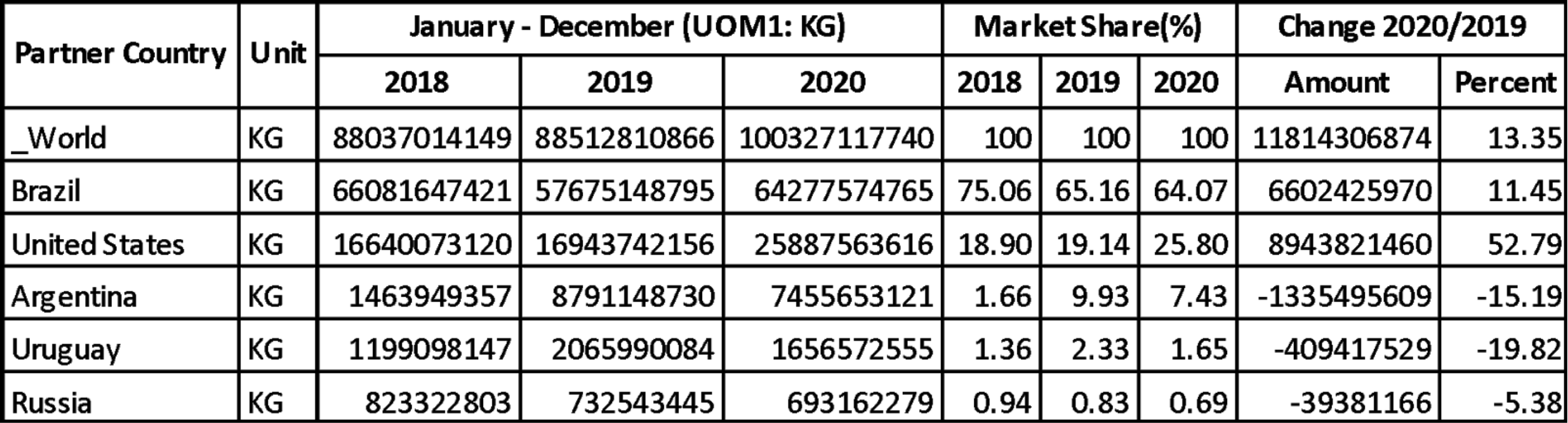

In 2020, Brazil shipped 64.3 million tons, and the U.S. 25.9 million tons to China. In third place was Argentina (7.5 million tons), followed by Uruguay (1.7 million tons) and Russia (693,162 tons).

Figure 2: Chinese Soybean Imports, 2020

Source: Trade Data Monitor

In 2017, the first year of the Trump administration, as protectionism and tensions over trade increased, China upped its soybeans imports from Brazil to 50.9 million tons from 38 million tons and cut its shipments from the U.S. to 32.9 million tons from 33.7 million tons. The following year, 2018, it slashed imports from the U.S. in half, to 16.6 million tons, while boosting imports from Brazil to 66.1 million tons.

In 2020, as part of the phase one trade deal trying to make peace with the U.S., China boosted imports of U.S. soybeans to 25.9 million tons from 16.9 million tons in 2019. It maintained the level of imports from Brazil, with 64.3 million tons shipped in. That’s how much it needs the protein.

Overall, in 2020, China increased imports 13.3% to 100.3 million tons from 88.5 million tons. During the Covid-19 pandemic, it maintained strong levels of food imports. It was also having to rebuild domestic pork herd after African swine fever killed as many as 200 million pigs. Despite a recent reoccurrence of the disease, demand is likely to remain robust. The country’s crushers also produce soyoil out of soybeans for cooking. The world’s most populous country will always have to eat.

Read also: How Will Coronavirus Impact Soybean Meal Prices?

Read also: The Impact Covid-19 Soybean Prices a Comparision with SARS

Read also: How Is the Brazil Soybean Cash Market Structured during the 2021 Harvest?

Read also: Infrastructure Developments in the Americas and Their Impact on Corn & Soybean Trade Flows