How Is European Canola Priced at the Beginning of the 2021-22 Marketing Year?

Reading time: 5 minutes

At the beginning of 2021, Canola (or Rapeseed) global stocks are scarce due to a lower supply. Moreover, with energy prices recovering more than well and the booming Chinese economy massively importing all types of Vegoils, European Canola prices are continuously leveraged and surged since January 2021. The pricing of European Canola is a crucial indicator, as it impacts the global Canola pricing trends.

Thus, with Germany and France being respectively the World’s 4th and 5th Canola producers and having a higher production than last year, the European Canola price fell. Now that the new campaign has started and harvesting is well underway, how did the pricing evolve between the previous and current marketing years, and how is it shaping up for the current campaign?

European Cash Canola Prices In the First Half of 2021

Marked by the booming Chinese demand, European Canola prices surged dramatically. Additionally, while the stocks for Canola Oil were low, the relationship between Palm Oil and Soybean Oil and their pricing at the time leveraged Canola prices even more.

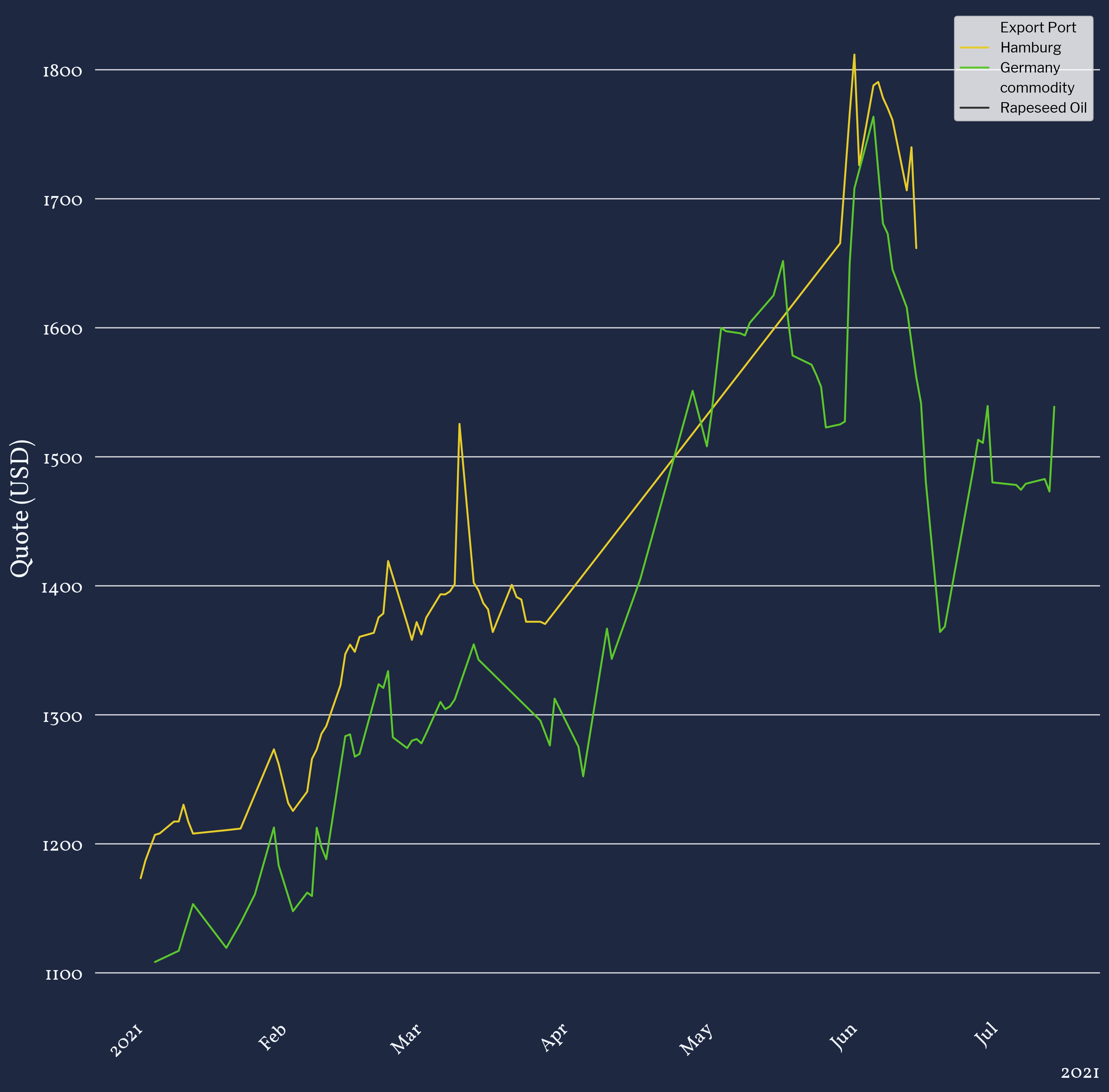

Figure 1: Germany Rapeseed Oil FOB Spot Quotes Between Jan & Jul 2021

As shown in Figure 1, FOB cash prices for Canola Oil from Germany increased by approximately 54% between January and June 2021. This steep increase is due to the Chinese-influenced bull market and the reflection of the market volatility due to the decreasing and dramatically low carry-over stock for the marketing year 2021-2022.

Figure 2: European Rapeseed Production (source: USDA)

However, by June 2021, in light of the latest crop reports confirming the crop production being higher than last year by about 6% (as shown in Figure 2) and thanks to a respite in the Vegoils craze, prices finally decreased and stabilized around the $1500/mt bar.

Nonetheless, the new Canola campaign is only just beginning, and pricing will, therefore, probably change.

Read also: Are Argentina Soybean Crush Exports at Risk?

Is the European Canola Market Tumbling Under A Larger Supply in 2021/2022 Marketing Year?

Taking the better European production in the 2021-22 marketing year into account, along with the hope of a recovering carry-over stock at its end, Canola Oil prices already dropped in June 2021 and stabilize around $1500/mt bar so far in July 2021.

Figure 3: Germany Canola (Rapeseed) Oil FOB Forward Quotes

Figure 3 displays the forward curves for Germany Canola Oil FOB quotes, based on the month of shipment, explaining the discontinuity between Figure 1 and 3. Most importantly, it shows that the price trend is mixed. While the German Canola Oil market is inverted, Hamburg exports seem to show a rebound of the bull market in Q1 2022, similarly to 2021.

This shows that the market is uncertain about the pricing of European Canola. Indeed, while the production is more important than last year, tensions with Canada led China to import more Canola Oil from Europe. Going further into the marketing year, if these tensions persist, they could lead to a renewed bull market for European Canola Oil.

Read also: China Wields $40B Soybean Import Demand as Trade Chip

In a Nutshell

At the beginning of 2021, European Canola cash prices surged due to:

- low available supply

- the booming Chinese market leveraging all Vegoil prices

- the reducing carry-over stocks

Following the crop reports with a better European Canola production in 2021 and with the Vegoils bull market calming down, prices went down at the end of June 2021, with Canola pricing stabilizing at around $1500/mt.

Looking at forward prices, the market is mixed. Although the supply is more important than for the previous marketing year, and the carry-over stock should increase and recover, the tensions between Canada and China could lead to a rebound of the bull market for Canola Oil.

Finally, the pricing of the European Canola was very much influenced by the Vegoils bull market. Yet, the improving crop reports did not prevent Canola prices from bolstering in the first two quarters of 2021. However, the spot pricing of European Canola for this marketing year is currently stable. The trend in the coming months strongly depends on Chinese Vegoils imports and the future Canola production in Canada and Australia.

Read also: Soybean Oil vs. Palm Oil prices