How to Avoid Demurrage Charges? A Ranking of 382 global Ports

Reading time: 4 minutes

What are Demurrage Charges?

Demurrage charges are a type of freight charges. They occur when a vessel remains stationed longer than the period contractually agreed to load or unload the ship’s cargo (called laytime). The charterer pays this charge to the shipowner for the delay in operations in the form of liquidated damages. As such, this charge can cause a loss to the seller or the buyer (based on the contract Incoterm) as it can increase the cost of freight. Therefore, avoiding these charges and loading delays can be a significant gain of time and money and should be incorporated into determining the best freight executions, along with tools like CFR matrices.

To determine which ports where to load cargo while minimizing the risk of having to pay demurrage charges, AgFlow built a ranking for bulk vessels and chemical tankers’ ports and regions.

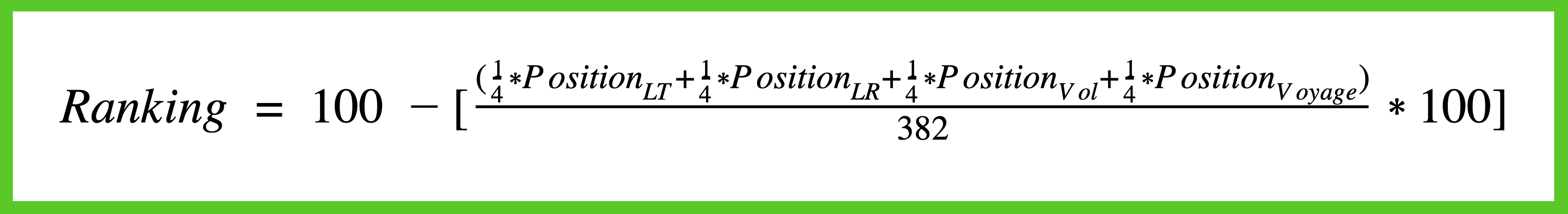

Our ranking considers four different parameters over 382 ports or group of ports and 111’606 voyages in 2020:

- loading time, LT = avg(loading time)

- loading rate, LR = avg(loading rate)

- cargo volume, Vol = avg(cargo volume)

- total number of voyages, Voyage Count = Sum(voyage_id)

Download the complete

2020 demurrage ranking (.xls)

382 ports, 78 Countries

Ranking Methodology

The total number of voyages helped avoid skewing the results. Sometimes, the average loading time and average loading rate ranks could be very high for ports with a low number of recorded voyages.

The final ranking weighted each parameter equally to avoid bias. The place with the lowest and was transformed into a percentage out of the best possible score.

Top 10 ports where to load to avoid demurrage charges

Download the complete

2020 demurrage ranking (.xls)

382 ports, 78 Countries

- All ports in the Top 10 ranking (except for Convent, USA) placed poorly in average loading time but very well in the other categories. Therefore, larger ports with numerous voyages, larger cargo loading, and high loading rates ranked high.

- Convent itself is an outlier. It had the best rank in average loading time, average loading rate and ranked third in average cargo volume. Still, it had only two recorded voyages in the dataset.

- Some ports specialize only in one commodity and its complexes. For example, Indonesia has only Palm Oil complexes.

Highlights

The ranking system showed that large ports fared particularly well due to larger cargo sizes, higher number of voyages, and more important loading rates.

Although we took the number of voyages into account, it didn’t prevent the most extreme skewing case with Covent (USA), which in all regards could be an excellent port to avoid demurrage charges. Still, the data is too sparse to be confident it ranks correctly at number two.

Another highlight of the ranking is that no region really prevails over any other. Nonetheless, Australia has three ports in the Top 10, showing it is a very efficient region overall to avoid demurrage charges.

The ranking does not take into account which commodities are loaded each port. Thus, while it is good to know that Bunbury (AUS) ranked first, it isn’t actionable information for one who for instance only trades Palm Oil.

Finally, even if this ranking is a useful tool to decide on freight execution, events like the Ever Given can have an impact on loading and unloading delays and results in demurrage charges, even though you had optimized your freight execution. There will still be some delays and, thus, demurrage charges.

Download the complete

2020 demurrage ranking (.xls)

382 ports, 78 Countries

Read also: A Guide to Chemical Tanker Types for Palm and Edible Oils

Read also: A guide to Bulk Carriers Types for Agricultural Commodities

Read also: Incoterms Guide (2020)

Read also: Ocean Freight Rates for Dry Bulk Cargoes in 2020

Read also: Infrastructure Developments In The Americas And Their Impact On Corn & Soybean Trade Flows